We learned earlier today that Zurich Insurance Group (ZURN SW / Market cap $105bn) has submitted an improved proposal to acquire Beazley (BEZ LN / £6.8bn), the London-listed specialty insurer. Zurich is offering to acquire 100% of Beazley in an all-cash transaction, marking its largest strategic move in over a decade and a clear step-up in its stated push into global specialty insurance. Under the proposal, Beazley shareholders would receive 1,280p in cash per share, implying an equity value of £7.7bn. The offer represents a premium of 56% to Beazley’s undisturbed closing price on Friday. Zurich had previously submitted a 1,230p cash proposal on 4th January, which Beazley’s board rejected as "significantly undervaluing" the business. This is clearly an aggressive bear hug – prices that are being offered are already at the top end of those offered in comparable M&A situations. This appears to be a move from Zurich to recognise that they (and the sector) are going ex growth, the cycle really started to turn in 2024 and there is headline pressure on rates now. In buying Beazley it would acquire a number of niche products (Cyber, Marine, Aviation etc) in a size material enough to matter, likely an attempt to give growth. It would acquire a group specialist underwriters who know what they are doing in these arenas and it could take 10-15yrs for them to build this organically. However - at these levels it is already paying a good price for it. In keeping with the tactics of a hug it seems likely there will be significant shareholder pressure the target to engage.

Zurich says the transaction would create a global specialty insurance platform with ~$15bn of gross written premiums, anchored by Beazley’s Lloyd’s franchise and Zurich’s global commercial footprint. The deal would be funded through a mix of existing cash, new debt facilities and an equity placing, and is described as accretive to Zurich’s FY27 financial targets. Completion would be subject to Beazley shareholder approval and customary regulatory clearances across key jurisdictions. The PUSU deadline is 16 February 2026, by which Zurich is required to announce a firm intention to make an offer.

To sum it up - Zurich’s move from 1,230p, which the board rejected as significantly undervaluing Beazley, to 1,280p, now puts the bid much closer to where recent London Market control deals have cleared on capital multiples. If Beazley pushes back again, it will likely need to point to a clear valuation ballpark or a credible alternative route to value, especially considering that Zurich's offer competes favourably with comparable precedent valuations.. It is hard to see how this could really be materially higher than the slated 1280p price.

Regulatory risk looks manageable as the overlap is concentrated in a few specialty commercial lines, most obviously specialty casualty and commercial property, with broader markets remaining fragmented and broker-led.

Business Overview

Beazley is a specialist insurer focused on harder, more technical risks, where clients and brokers value expertise and underwriting judgement over commoditised capacity. It writes a broad spread of niche products, including cyber (ransomware, data breach, business interruption from an IT event), management liability (lawsuits or regulatory actions involving directors and senior management), property, and other specialty lines (aviation, marine, political and contingency, environmental, and other niche cover). It is set up to write globally through multiple “platforms”, combining Lloyd’s wholesale underwriting with owned operations in North America and Europe. The company earns money from underwriting margins on specialist risks, plus income from its investments. The mix is weighted to specialty and property, with cyber also a material pillar. Out of $5.8bn in revenue in FY24, specialty risks accounted for about 32% of revenue in FY24, property risks accounts for about 26%, cyber risks about 20%, MAP (marine, aviation, political) risks about 16%, and digital risk about 4%. Geographically, the business is UK-led and Beazley discloses geography on a “where the policy is written” basis, not where the underlying customer is. On that definition, around 78% of insurance revenue is booked in the UK (Lloyd’s), with about 15% written through its US insurance companies and about 7% through its European insurance company. This is a legal-entity and placement lens, so a US corporate policy placed into Lloyd’s will still show up as “UK” in this split, even though the economic exposure is to a US risk.

Zurich is a global multi-line insurer with three main segments: Property & Casualty (P&C), Life, and Farmers (a fee-based services business to the Farmers Exchanges in the US, which Zurich does not own). In simple terms, it sells protection to individuals and families (notably motor and home), and to businesses from SMEs to multinationals (commercial property, liability and specialty). In Life, it offers protection and savings products, with a meaningful emphasis on unit-linked solutions alongside other savings and annuities. In its FY24, the group disclosed around $44.8bn of P&C insurance revenue, $11.7bn of Life revenue (under IFRS, which differs from the $33bn in gross premiums and deposits that Zurich reports on their financials), and $4.6bn of Farmers fee service revenue. Within P&C, the disclosed mix is rather broad, with property being the largest share and motor also substantial, then a spread across liability, workers’ injury and other lines. In Life, the mix is dominated by unit-linked, with protection a meaningful second pillar and savings/annuities smaller. Geographically, Zurich’s P&C revenue is split across EMEA (~42% of revenue), North America (~36.5%), APAC (~10.6%) and LATAM (~10.4%). Life insurance skews more to EMEA and Latin America, with Asia Pacific and North America smaller, while P&C revenue is largely generated in EMEA and North America. The annual report also points to bolt-on expansion in selected markets and products, alongside an emphasis on distribution partnerships in Life.

Valuation

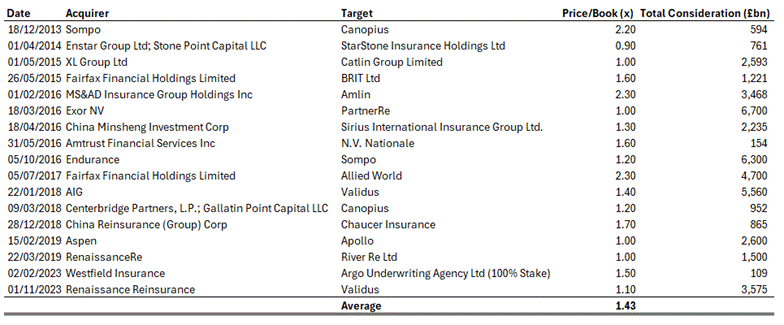

Clearly the target rejected 1,230p as “significantly undervaluing” the business. It will be interesting to see what language is used in response to a slightly improved 1,280p. Significantly undervaluing tends to imply a 10-15% valuation gap, for whatever that is worth. Looking at previous transactions in the Lloyds space we appear to already be at the top end of previously applied multiples. As seen in Fig. 1 below, Amlin/Mitsui (2015) marked the top in this regard, coming in at 2.4x tangible book value (recent average is far more like 1.5x). This was done at a 35% premium to undisturbed, so today’s move is a stand out in this regard as well as from a multiples basis. This sector organically trades on ~1-2x, so 2.4x provides a comfortable cushion as an M&A premium. It could be argued that Beazley is the best asset left listed in the space, and that it should command a premium higher than other takeouts but consensus forward BV/PS is about 565p for Beazley, meaning 1280p represents a multiple of about 2.3x. We can look back at Beazley’s latest disclosed TNAV 536.1p (as of 30 Jun 2025) and compare this to the current trading levels of Hiscox (1.23x) and Lancashire (0.95x), again suggesting we are very much in the zone where one might expect a target to accept an M&A proposal. One would hope the bid ask spread shouldn’t be that wide therefore, it would seem difficult for the target to justify a rejection much above the currently proffered level.

Zurich says the transaction would create a global specialty insurance platform with ~$15bn of gross written premiums, anchored by Beazley’s Lloyd’s franchise and Zurich’s global commercial footprint. The deal would be funded through a mix of existing cash, new debt facilities and an equity placing, and is described as accretive to Zurich’s FY27 financial targets. Completion would be subject to Beazley shareholder approval and customary regulatory clearances across key jurisdictions. The PUSU deadline is 16 February 2026, by which Zurich is required to announce a firm intention to make an offer.

To sum it up - Zurich’s move from 1,230p, which the board rejected as significantly undervaluing Beazley, to 1,280p, now puts the bid much closer to where recent London Market control deals have cleared on capital multiples. If Beazley pushes back again, it will likely need to point to a clear valuation ballpark or a credible alternative route to value, especially considering that Zurich's offer competes favourably with comparable precedent valuations.. It is hard to see how this could really be materially higher than the slated 1280p price.

Regulatory risk looks manageable as the overlap is concentrated in a few specialty commercial lines, most obviously specialty casualty and commercial property, with broader markets remaining fragmented and broker-led.

Business Overview

Beazley is a specialist insurer focused on harder, more technical risks, where clients and brokers value expertise and underwriting judgement over commoditised capacity. It writes a broad spread of niche products, including cyber (ransomware, data breach, business interruption from an IT event), management liability (lawsuits or regulatory actions involving directors and senior management), property, and other specialty lines (aviation, marine, political and contingency, environmental, and other niche cover). It is set up to write globally through multiple “platforms”, combining Lloyd’s wholesale underwriting with owned operations in North America and Europe. The company earns money from underwriting margins on specialist risks, plus income from its investments. The mix is weighted to specialty and property, with cyber also a material pillar. Out of $5.8bn in revenue in FY24, specialty risks accounted for about 32% of revenue in FY24, property risks accounts for about 26%, cyber risks about 20%, MAP (marine, aviation, political) risks about 16%, and digital risk about 4%. Geographically, the business is UK-led and Beazley discloses geography on a “where the policy is written” basis, not where the underlying customer is. On that definition, around 78% of insurance revenue is booked in the UK (Lloyd’s), with about 15% written through its US insurance companies and about 7% through its European insurance company. This is a legal-entity and placement lens, so a US corporate policy placed into Lloyd’s will still show up as “UK” in this split, even though the economic exposure is to a US risk.

Zurich is a global multi-line insurer with three main segments: Property & Casualty (P&C), Life, and Farmers (a fee-based services business to the Farmers Exchanges in the US, which Zurich does not own). In simple terms, it sells protection to individuals and families (notably motor and home), and to businesses from SMEs to multinationals (commercial property, liability and specialty). In Life, it offers protection and savings products, with a meaningful emphasis on unit-linked solutions alongside other savings and annuities. In its FY24, the group disclosed around $44.8bn of P&C insurance revenue, $11.7bn of Life revenue (under IFRS, which differs from the $33bn in gross premiums and deposits that Zurich reports on their financials), and $4.6bn of Farmers fee service revenue. Within P&C, the disclosed mix is rather broad, with property being the largest share and motor also substantial, then a spread across liability, workers’ injury and other lines. In Life, the mix is dominated by unit-linked, with protection a meaningful second pillar and savings/annuities smaller. Geographically, Zurich’s P&C revenue is split across EMEA (~42% of revenue), North America (~36.5%), APAC (~10.6%) and LATAM (~10.4%). Life insurance skews more to EMEA and Latin America, with Asia Pacific and North America smaller, while P&C revenue is largely generated in EMEA and North America. The annual report also points to bolt-on expansion in selected markets and products, alongside an emphasis on distribution partnerships in Life.

Valuation

Clearly the target rejected 1,230p as “significantly undervaluing” the business. It will be interesting to see what language is used in response to a slightly improved 1,280p. Significantly undervaluing tends to imply a 10-15% valuation gap, for whatever that is worth. Looking at previous transactions in the Lloyds space we appear to already be at the top end of previously applied multiples. As seen in Fig. 1 below, Amlin/Mitsui (2015) marked the top in this regard, coming in at 2.4x tangible book value (recent average is far more like 1.5x). This was done at a 35% premium to undisturbed, so today’s move is a stand out in this regard as well as from a multiples basis. This sector organically trades on ~1-2x, so 2.4x provides a comfortable cushion as an M&A premium. It could be argued that Beazley is the best asset left listed in the space, and that it should command a premium higher than other takeouts but consensus forward BV/PS is about 565p for Beazley, meaning 1280p represents a multiple of about 2.3x. We can look back at Beazley’s latest disclosed TNAV 536.1p (as of 30 Jun 2025) and compare this to the current trading levels of Hiscox (1.23x) and Lancashire (0.95x), again suggesting we are very much in the zone where one might expect a target to accept an M&A proposal. One would hope the bid ask spread shouldn’t be that wide therefore, it would seem difficult for the target to justify a rejection much above the currently proffered level.

Fig 1: Comparable Transaction Multiples (Source: MKI)

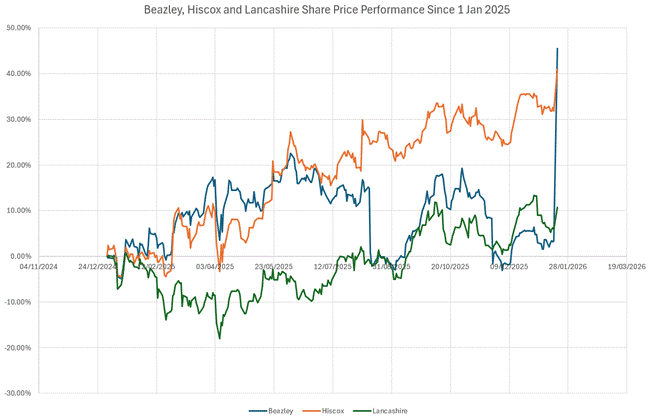

Beazley underperformed its peer group over much of 2025, as shown in Fig. 2 below. From the start of the year through late summer, Beazley’s share price lagged the sustained outperformance seen at Hiscox (HSX LN / £4.9bn) and generally trailed Lancashire (LRE LN / £1.5bn) , with greater volatility and fewer periods of sustained relative strength. This came from an effort to deliver growth via launching a Bermudan platform rather than simply returning capital to shareholders, a tactic that the market had previously been rewarding. The market has been worried that this capital allocation strategy will hamper efforts to return capital. The cyber markets have not helped either, with US conditions in particular remaining weak and weighing on sentiment towards specialist writers with meaningful cyber exposure. This share price backdrop matters when assessing Zurich’s approach. Beazley enters this process not as a momentum outperformer, but as a business where relative underperformance has already tested shareholder patience, particularly around capital allocation priorities.

Sustaining a near 2.4x tangible capital multiple typically requires a buyer to underwrite scarcity value and to articulate a credible "why this buyer, why now" synergy and capital thesis, rather than relying on a general sector rerating. It is possible that Zurich is willing to push the offer to the higher end of the valuation spectrum due to the appeal of high-growth segments like Cyber, Marine and Aviation. Most traditional insurance segments are characterised by low growth (cars, property, planes, etc), for a giant player it is hard to extract real additional growth from these arenas, given the seeming turn in the cycle.

The clearest routes to making the economics work at this level tend to be a mix of cost and operating leverage, for example overlapping corporate functions and procurement, revenue or distribution benefits through cross sell into an expanded global specialty platform, and balance sheet optimisation through capital diversification benefits across lines and geographies, reinsurance purchasing scale and potential rating agency efficiency. In that sense, Zurich’s statement reads as an attempt to position Beazley not as a simple earnings acquisition, but as a scarce London Market specialty platform where paying at the top end of the table’s observed valuation range can be justified if the strategic and capital benefits are real and executable.

Sustaining a near 2.4x tangible capital multiple typically requires a buyer to underwrite scarcity value and to articulate a credible "why this buyer, why now" synergy and capital thesis, rather than relying on a general sector rerating. It is possible that Zurich is willing to push the offer to the higher end of the valuation spectrum due to the appeal of high-growth segments like Cyber, Marine and Aviation. Most traditional insurance segments are characterised by low growth (cars, property, planes, etc), for a giant player it is hard to extract real additional growth from these arenas, given the seeming turn in the cycle.

The clearest routes to making the economics work at this level tend to be a mix of cost and operating leverage, for example overlapping corporate functions and procurement, revenue or distribution benefits through cross sell into an expanded global specialty platform, and balance sheet optimisation through capital diversification benefits across lines and geographies, reinsurance purchasing scale and potential rating agency efficiency. In that sense, Zurich’s statement reads as an attempt to position Beazley not as a simple earnings acquisition, but as a scarce London Market specialty platform where paying at the top end of the table’s observed valuation range can be justified if the strategic and capital benefits are real and executable.

Fig 2: Beazley, Hiscox and Lancashire Share Price Performance Since 1 Jan 2025 (Source: MKI / Bloomberg)

Bear Hug Tactics

Insurance is not a sector where one tends to see hostile offers, particularly at Lloyds names where the nature of syndicates adds a human element to the story. Thus there might be risk buried within Zurich’s obvious frustration with the target. That it has chosen to take the improved offer directly to shareholders, and thus bear hug the target, likely suggests there is risk that Zurich worries the target will once again not conform, and a bid ask spread remains. The nature of Beazley’s business, in particular the exposure to Cyber markets (which are poorly understood by many) probably limits the list of potential acquirers it is hard to see a Japanese buyer for an asset such as this.

Antitrust

Zurich buying Beazley would look, from a competition perspective, like a bolt-on into specialty commercial insurance rather than a merger of two broad personal lines players, given Beazley's focus on London Market specialty classes. The sensible way to frame overlap is by product line rather than solely by headline geography. The clearest horizontal overlap is in commercial property and specialty casualty, because those are core to Beazley and sit within Zurich’s broader P&C segment, even if Zurich does not break them out in the same way publicly. That is where customers and brokers might reasonably treat the two firms as alternative capacity providers. Outside those lines, overlap should be limited, Zurich’s retail, SME and Life activities are not where Beazley is concentrated, and Beazley’s smaller digital and niche buckets are unlikely to shift market structure.

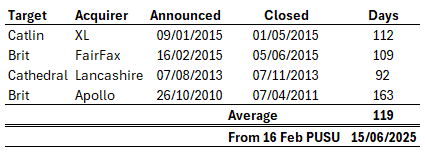

Process-wise, insurance merger control is usually run as a set of national and product markets, with regulators looking line by line at whether the combined group could raise prices or tighten terms, and how much power brokers and alternative carriers have to push back. The obvious filing set is UK CMA, EC, US HSR, and Switzerland, with additional local approvals depending on where material premiums are written. Substantively, the starting presumption is that specialty and Lloyd’s markets are fragmented, with plenty of credible competitors and capacity that can move, which is why prior London Market control deals have generally not turned on remedies. The areas to diligence are narrower classes where Beazley is a clear leader, cyber is the obvious one, plus any property catastrophe or specialty liability niches where Zurich already has meaningful scale. We can look back at some precedent Lloyds transactions to see that one might expect a transaction such as this to take about 120 days. Were there to be a firm announcement of a deal on the PUSU deadline of 16th February, this would imply a closing date of 15th June.

Insurance is not a sector where one tends to see hostile offers, particularly at Lloyds names where the nature of syndicates adds a human element to the story. Thus there might be risk buried within Zurich’s obvious frustration with the target. That it has chosen to take the improved offer directly to shareholders, and thus bear hug the target, likely suggests there is risk that Zurich worries the target will once again not conform, and a bid ask spread remains. The nature of Beazley’s business, in particular the exposure to Cyber markets (which are poorly understood by many) probably limits the list of potential acquirers it is hard to see a Japanese buyer for an asset such as this.

Antitrust

Zurich buying Beazley would look, from a competition perspective, like a bolt-on into specialty commercial insurance rather than a merger of two broad personal lines players, given Beazley's focus on London Market specialty classes. The sensible way to frame overlap is by product line rather than solely by headline geography. The clearest horizontal overlap is in commercial property and specialty casualty, because those are core to Beazley and sit within Zurich’s broader P&C segment, even if Zurich does not break them out in the same way publicly. That is where customers and brokers might reasonably treat the two firms as alternative capacity providers. Outside those lines, overlap should be limited, Zurich’s retail, SME and Life activities are not where Beazley is concentrated, and Beazley’s smaller digital and niche buckets are unlikely to shift market structure.

Process-wise, insurance merger control is usually run as a set of national and product markets, with regulators looking line by line at whether the combined group could raise prices or tighten terms, and how much power brokers and alternative carriers have to push back. The obvious filing set is UK CMA, EC, US HSR, and Switzerland, with additional local approvals depending on where material premiums are written. Substantively, the starting presumption is that specialty and Lloyd’s markets are fragmented, with plenty of credible competitors and capacity that can move, which is why prior London Market control deals have generally not turned on remedies. The areas to diligence are narrower classes where Beazley is a clear leader, cyber is the obvious one, plus any property catastrophe or specialty liability niches where Zurich already has meaningful scale. We can look back at some precedent Lloyds transactions to see that one might expect a transaction such as this to take about 120 days. Were there to be a firm announcement of a deal on the PUSU deadline of 16th February, this would imply a closing date of 15th June.

Fig 3: Precedent Lloyds Transactions (Source: MKI)

Net, the antitrust work will come down to allocating each party’s written premium by country of risk and class, then testing concentration in the UK and US in particular, across specialty commercial lines, cyber and large commercial property, including any Lloyd’s or London Market segments where both groups write through the same broker channels. If combined shares stay modest in those defined markets, this should read as conventional specialty consolidation, with the main risk being filing scope and regulatory timing rather than structural remedies. If any pocket looks tighter, regulators would look to broker power and the availability of alternative capacity, which typically limits competition concerns in this market.

Conclusion

In conclusion, Zurich’s move from 1,230p, which the board rejected as significantly undervaluing Beazley, to 1,280p, now puts the bid much closer to where recent London Market control deals have cleared on capital multiples. If Beazley pushes back again, it will likely need to point to a clear valuation ballpark or a credible alternative route to value, especially considering that Zurich's offer competes favourably with comparable precedent valuations.

This is clearly an aggressive bear hug – prices that are being offered are already at the top end of those offered in comparable M&A situations. This appears to be a move from Zurich to recognise that they (and the sector) are going ex growth, the cycle really started to turn in 2024 and there is headline pressure on rates now. In buying Beazley it would acquire a number of niche products (Cyber, Marine, Aviation etc) in a size material enough to matter, likely an attempt to give growth. It would acquire a group specialist underwriters who know what they are doing in these arenas and it could take 10-15yrs for them to build this organically. However - at at these levels it is already paying a good price for it. In keeping with the tactics of a hug it seems likely there will be significant shareholder pressure the target to engage.

Conclusion

In conclusion, Zurich’s move from 1,230p, which the board rejected as significantly undervaluing Beazley, to 1,280p, now puts the bid much closer to where recent London Market control deals have cleared on capital multiples. If Beazley pushes back again, it will likely need to point to a clear valuation ballpark or a credible alternative route to value, especially considering that Zurich's offer competes favourably with comparable precedent valuations.

This is clearly an aggressive bear hug – prices that are being offered are already at the top end of those offered in comparable M&A situations. This appears to be a move from Zurich to recognise that they (and the sector) are going ex growth, the cycle really started to turn in 2024 and there is headline pressure on rates now. In buying Beazley it would acquire a number of niche products (Cyber, Marine, Aviation etc) in a size material enough to matter, likely an attempt to give growth. It would acquire a group specialist underwriters who know what they are doing in these arenas and it could take 10-15yrs for them to build this organically. However - at at these levels it is already paying a good price for it. In keeping with the tactics of a hug it seems likely there will be significant shareholder pressure the target to engage.