The market spent most of Friday musing over various quesKons swirling around the news that Rio Tinto (RIO LN, RIO AU / Market Cap £104bn) and Glencore (GLEN LN /£48bn) are in early stage talks. The general percepKon was that the share price reacKons, at -3% (although -6% in Australia) and +10% respecKvely, wereencouraging – the generally held belief is that it is more likely than not that this combinaKon finally comes to fruiKon. UnquesKonably though, there are a numberof quesKons which remain hard to answer – although it feels preparaKon work for the transacKon has been going on for some Kme, it seems there is muchcomplexity yet to work through. There is no expectaKon in the market that a firm announcement would come before the deadline of 5th February, but anoverriding confidence that talks will get extended. We don’t have many of these answers – perhaps simply because they don’t yet exist – but we wanted to write aquick wrap of these discussion points to reflect what we see as the current state of play.

In summary it felt that because everything is so preliminary the market is saying to Rio “fine – but we’re in somewhat of a holding pattern, we’re reserving real judgement until we have more details”. Unquestionably those we spoke with in Australia were more cynical about the ability to actually do this than London investors were – and even within this there were a number of moving parts. It felt that Rio was being given the benefit of the doubt by London in at least there is the possibility that they are going to be able to thread the needle of (a) financial discipline, (b)strategic consistency via (c) the complications of the Dual Listed Company. So all of these topics are swirling around – if Rio can find a way to get all those stars to align then shareholders will back them, but most are simply saying that they will judge this as and when the details are known. The London market sees it could theoretically work but Australia believe the ability to walk this tightrope less. And of course them overlaying this is the concept of China, which has both direct and indirect influence on the outcome. We can even take the complications a step further than this when we then bolt in the Glencore perspective – the genesis of this proposal is Glencore as a seller, and a seller which expects a premium. Yet there is a narrative that Rio can find a way to dip in to buy assets it wants. This is probably why we saw Friday’s press around Rio’s willingness to own coal again (at least for some short term) – for obvious reasons this didn’t scream of Rio actually wanting coal, but more that they will own it if they need to. So the idea of Rio doing a nil premium deal of cherry picking assets (which was a discussion in Australia) really is inconsistent with the narrative that this is Glencore selling itself. Rio need to find a way to thread that needle to suit its own demands, whilst keeping Glencore and China happy too. Complicated.

If Rio can navigate all of these demands and then get around the Chinese elephant in the room, there is of course another question – do they bump into another BHP shaped elephant? Many continue to argue BHP simply have to look at this asset, despite the manner in which this has been down-talked (both on Friday and more generally through 2025). Many saw the coal stories of Friday as a potential signal that perhaps Rio has learned from BHP’s failure with Anglo – rather than try to cherry pick assets (remembering BHP tried to force disposal of unwanted businesses prior to acquisition), Rio are maybe just cracking on, willing to deal with these parts post deal rather than pre. Perhaps this is Rio’s way of saying to Glencore that in the event of a contested deal they are a better partner, they would also be telling the market they are better at executing M&A than BHP. Does this therefore throw down the gauntlet to BHP somewhat though – with Anglo they refused to move on either price or structure then ended up doing both, by the time they DID finally come for Anglo it was too late. BHP know they played Anglo too cute – so are all the denials of interest in Glencore just teeing them up to come back at the 11th hour again? Who knows – but this will clearly be one of the main talking points ahead.

Lots and lots of discussion but in general, we would group the main talking points of Friday into the following:

Structure

The first question on everyone’s lips has always been “what happens to coal?”. Despite news flow on Friday suggesting to the contrary, most still see it as unlikely that Rio would perform a full u-turn and own Glencore’s copper assets on a long term basis. It spent several years disposing both its thermal coal and coking coal assets, even selling some to Glencore itself – reverting back to these strategically would be deeply contrary to all recent messaging. As we discussed on Friday morning (see below) there is still belief that these assets, perhaps with Iron Ore and Glencore’s marketing division, could get spun into some kind of Australian listed NewCo. It is hard for Rio derive more value from the marketing business than Glencore has itself – and the Iron Ore assets deserve a local Aussie listing, so perhaps this is the neatest way to structure a transaction. What we would end up with here would be a London listed Base business (Copper / Aluminium / Lithium) NewCo, which would likely command a real premium in the market given its exposure to a basket of assets the market loves right now – it would have a wonderful story to tell, being the only asset of scale that gives such exposure without the dilutions of other base assets. Its sister company would be an Australian listed Bulk business (Coal / Iron Ore / Marketing ) which would be a yield-generating company, something likely to be genuinely attractive to local Australian investors. Clearly there are many potential complexities in the sequencing of a merger and demerger as alluded to here – but the market is convinced there is real value to be derived, hence the lack of share price erosion in Rio in London on Friday. As discussed above though, there was debate on whether Rio has learned from BHP’s Anglo parable – maybe the only way to do a deal such as this is to acquire the whole asset and effect whatever disposals necessary post close – there is a genuine possibility that they own the whole of Glencore (ie including coal) for at least some short term going forward. Noone seemed to believe this was a long term proposition though.

The Dual Listed Company

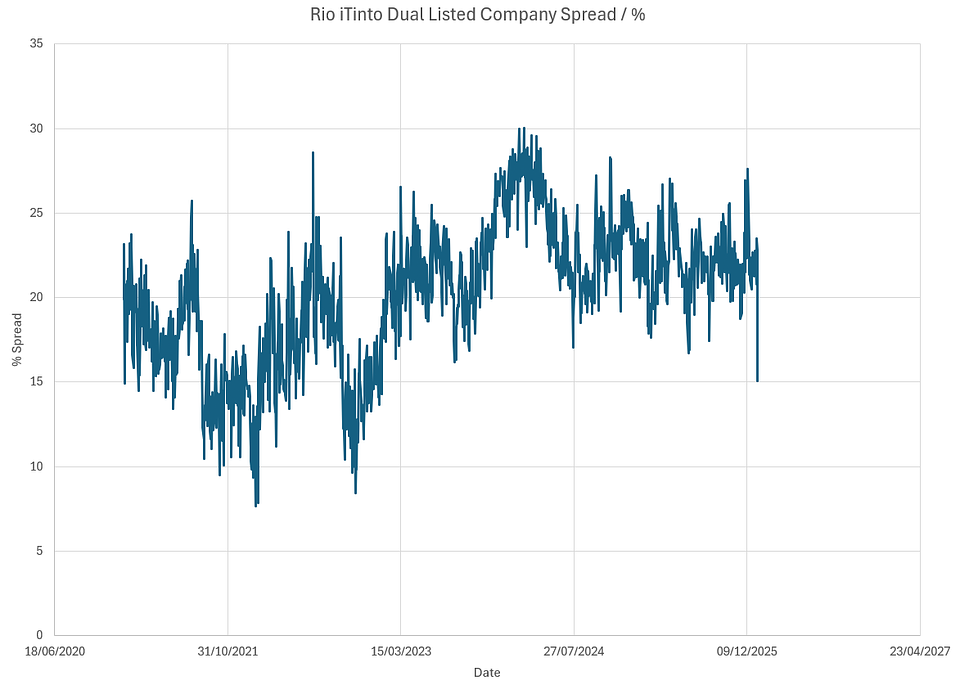

Given the volume of discussion about the creation of an Australian and London structure, very quickly one ends up contemplating the Dual Listed structure of Rio – the question being whether this presents an opportunity to take advantage of this, rather than see it as an impediment to M&A. Despite activist pressure to collapse the structure – Rio has always stressed it would have no need to – it could still issue large amounts of equity for M&A without doing so – something that’s never been tested in a parallel fashion before so no one really knows how this might work. Clearly Rio should want to issue (>20% more valuable) Australian paper – but Glencore and its holders should want to receive the London paper. Maybe there is an intention to offer a blend of both or maybe there is a clever way to splice this into the creation of new local listings for the proforma companies – no one really had any answers to this. The DLC spread tightened (with AU – 6% and LN -3%) on Friday – it will be interesting to see whether this continues in coming days – it could well be that directional Australian investors simply thought Rio would sell off harder in London and now share some value optimism too. But whichever way we cut it, the fate and implications of the DLC structure remain some of the big talking point unknowns.

Potential Premia

The Australian market was awash with speculation of a potential nil-premium transaction – presumably hot on the heels of Anglo/Teck. The clear distinction here should come from the genesis of this transaction – it has been speculated for some time that Glencore is a seller, it would be a huge surprise to see anything other than a decent premium paid. Having said that, with limited synergies on offer, and the transaction needing to be paper based, the discussion in the market swirled around numbers like 15%ish rather than anything more meaningful. Of course with Glencore +10% on Friday, this then led to a wide-ranging discussion about how much was already being baked in – or conversely what value creating would ensure from the creation of NewCo – a circular reference back to the structure questions above (and to some degree the DLC, given the unknown nature of paper issued).

Synergies

There is limited overlap between the asset bases of the companies so the potential for classical synergy derivation isn’t huge, cost benefits will be largely limited to central cost eliminations and revenue benefits will come from the expansion of marketing scale. This isn’t a merger that will be driven by this kind of benefit though – the belief is that it’s an opportunity to reset the structure of the company (or companies) longer term – through the kind of shapes discussed above. We’ve seen synergy numbers like $10bn being thrown around for what that is worth.

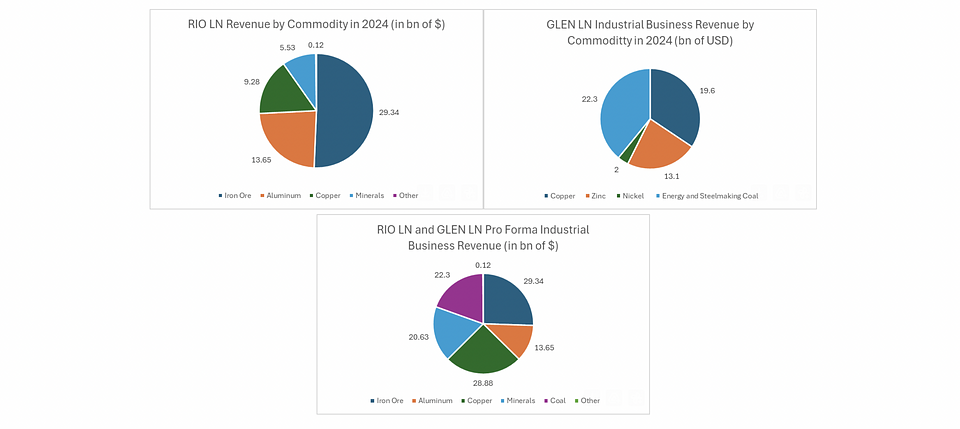

Antitrust

Clearly the proforma business (with or without a subsequent break up) would be a real mining giant. Most assume a transaction will take 18-24mo to consummate – but this is seen more as a function of local geographical approvals than anti-trust worries. NewCo will be the largest producer of mined copper, seaborne thermal coal, bauxite and zinc. It will be only behind BHP in Iron Ore volumes and Glencore’s marketing business obviously gives it extra clout in all of these regards. But there really is very limited commodity overlap between the companies, only in copper is there anything meaningful - as we known from Anglo / Teck antitrust processes, these aren’t seen as problematic markets. Noone thinks there is any real anti-trust concern that needs modelling. Of course China approvals will be key, and China plays a much bigger role anyway.

China

One of the more interesting angles for discussion has been China, from multiple perspectives including (1) the Chinalco holding and their potential ability to block a deal through the size of their holding, if one assumes ‘normal’ scheme vote turn out (2) Chinalco’s willingness to see its equity ownership position diluted by the issuance of equity to Glencore shareholders, (3) the political considerations of a China SOE being the largest shareholder in Rio for other Countries that will need to approve any deal and in particular the debate as to what level of influence do they have indirectly even though there are governance structure in place to limit direct influence (3) SAMR and what they may seek to extract from any tie-up in return for their approval – and as an aside to this whether this has any implications for the timetable and outcome of approving the Anglo-Teck combination.

Clearly these are not standalone factors but are all interlinked. We have been told that Chinalco should not be seen as “another shareholder” but a representation of China as a strategic partner and that their investment in Rio therefore is a strategic one rather than a purely financial investment. The former CEO of Rio saw it as a priority for him to spend significant time around this relationship, to ensure it was a productive and positive one and to differentiate the way that China viewed Rio compared to other sector players, including BHP for example. Equally, from a strategic perspective, we understand that internally it has been a priority for Rio to find a way to reduce the percentage ownership holding of Chinalco in Rio, in order to free up head room to the upper ownership level permitted by the Australian government as a condition of Chinalco initially acquiring its stake in Rio, which could enable the Company to undertake purchases of its own shares. We are told that management sees this as the highest returning use of its capital – hence the reports in the past 12 months of Rio exploring options to exchange Chinalco TopCo shares for ownership positions in certain assets.

Before any tie-up is announced, one would expect many of these issues to have been resolved and investors will want any definitive announcement to include an irrevocable intent from Chinalco to vote in favour of the schemes – no one will want a key risk to the scheme vote to be persuading the strategic Chinese investor/largest shareholder of the merits of the proposed deal.

Of course combining with Glencore using equity could help both Rio and China to pursue their own aims. For Rio, the dilution from equity issuance and consequent reduced shareholding of Chinalco in the enlarged group, could create the headroom to facilitate a share buyback using the existing balance sheet capacity and enhanced cash flows of the enlarged group. This buyback could also be a helpful strategy to help to absorb any selling of Rio shares by Glencore shareholders exiting the enlarged group post closure and mitigate any share price impact of any over-supply. Over time a share buyback would accrete Chinalco back to its current permitted shareholding level. Additionally, China may be a potential acquiror of any non-core asset disposals post closure, and could potentially even use Rio shares rather than cash as currency, again creating further buyback headroom. For Chinalco, this is an opportunity to increase its influence by being the strategic investor in the largest global mining company and for China it may seek to extract further benefits as part of the approval process, both in terms of Chinalco’s voting power and SAMR’s approval requirements.

Clearly many complexities here to navigate, but it is for this very type of large M&A scenario that the China/Chinalco relationship has been such a focus for Rio’s senior management. Consequently, we would not be expecting Rio to be pursuing this opportunity at this time unless it was confident that an acceptable ‘package’ could be achieved and that it would have the support and backing of its largest shareholder as well as a path to regulatory approval from SAMR.

Interlopers

Obvioulsy there was much discussion about BHP on Friday too. Given their 11th hour re-approach for Anglo American late last year, the market knows that BHP is trying to solve its own issues via M&A, and is keen on Copper right now. So there will be endless discussion about whether BHP would look to compete for Glencore – they repeatedly told everyone they had moved on from Anglo only to re-emerge when shareholder votes loomed, we know plenty who are unwilling to take BHP’s word for it when they say Glencore isn’t of interest. However – this IS what they say, both the company and those close to it have stressed (both through 2025 and even on Friday) that this wasn’t an interesting situation to them. Glencore’s marketing business is probably eeven less attractive to BHP than to Rio, so its always been fair to say that Rio has always been seen as a better stable-mate for Glencore than BHP – but its unlikely anyone will ever truly rule BHP out. How easy it is to really rule them IN though is a different story – the market’s gut instinct seems to suggest its unlikely in reality.

Conclusion

This was just meant to be a wrap of what we’ve seen being discussed in the market since Thursday night’s newsflow. Many of these topics need plenty more work, particularly the concept of the structure of any transaction. It seems highly unlikely still that Rio is a coal owner in anything other than a very short term structure, but they have probably learned from BHP/Anglo that playing things too cute risks embarrassing failure. We know that they will want to use an opportunity such as this to try and “solve” for the restrictions brought upon them by the Chinalco holding somewhat too. What the Chinese response to this will be is unknown, and presumably the more that is given in this way, the less Australian politicians will like the transaction. How the DLC helps or hinders M&A like this is still a hotly contested talking point. So, still way more questions than answers – but Rio’s performance on Friday was seen as emboldening, the market understands the potential for genuine value creation through this combination.

More as things develop further.

----------------------------------------

In summary it felt that because everything is so preliminary the market is saying to Rio “fine – but we’re in somewhat of a holding pattern, we’re reserving real judgement until we have more details”. Unquestionably those we spoke with in Australia were more cynical about the ability to actually do this than London investors were – and even within this there were a number of moving parts. It felt that Rio was being given the benefit of the doubt by London in at least there is the possibility that they are going to be able to thread the needle of (a) financial discipline, (b)strategic consistency via (c) the complications of the Dual Listed Company. So all of these topics are swirling around – if Rio can find a way to get all those stars to align then shareholders will back them, but most are simply saying that they will judge this as and when the details are known. The London market sees it could theoretically work but Australia believe the ability to walk this tightrope less. And of course them overlaying this is the concept of China, which has both direct and indirect influence on the outcome. We can even take the complications a step further than this when we then bolt in the Glencore perspective – the genesis of this proposal is Glencore as a seller, and a seller which expects a premium. Yet there is a narrative that Rio can find a way to dip in to buy assets it wants. This is probably why we saw Friday’s press around Rio’s willingness to own coal again (at least for some short term) – for obvious reasons this didn’t scream of Rio actually wanting coal, but more that they will own it if they need to. So the idea of Rio doing a nil premium deal of cherry picking assets (which was a discussion in Australia) really is inconsistent with the narrative that this is Glencore selling itself. Rio need to find a way to thread that needle to suit its own demands, whilst keeping Glencore and China happy too. Complicated.

If Rio can navigate all of these demands and then get around the Chinese elephant in the room, there is of course another question – do they bump into another BHP shaped elephant? Many continue to argue BHP simply have to look at this asset, despite the manner in which this has been down-talked (both on Friday and more generally through 2025). Many saw the coal stories of Friday as a potential signal that perhaps Rio has learned from BHP’s failure with Anglo – rather than try to cherry pick assets (remembering BHP tried to force disposal of unwanted businesses prior to acquisition), Rio are maybe just cracking on, willing to deal with these parts post deal rather than pre. Perhaps this is Rio’s way of saying to Glencore that in the event of a contested deal they are a better partner, they would also be telling the market they are better at executing M&A than BHP. Does this therefore throw down the gauntlet to BHP somewhat though – with Anglo they refused to move on either price or structure then ended up doing both, by the time they DID finally come for Anglo it was too late. BHP know they played Anglo too cute – so are all the denials of interest in Glencore just teeing them up to come back at the 11th hour again? Who knows – but this will clearly be one of the main talking points ahead.

Lots and lots of discussion but in general, we would group the main talking points of Friday into the following:

Structure

The first question on everyone’s lips has always been “what happens to coal?”. Despite news flow on Friday suggesting to the contrary, most still see it as unlikely that Rio would perform a full u-turn and own Glencore’s copper assets on a long term basis. It spent several years disposing both its thermal coal and coking coal assets, even selling some to Glencore itself – reverting back to these strategically would be deeply contrary to all recent messaging. As we discussed on Friday morning (see below) there is still belief that these assets, perhaps with Iron Ore and Glencore’s marketing division, could get spun into some kind of Australian listed NewCo. It is hard for Rio derive more value from the marketing business than Glencore has itself – and the Iron Ore assets deserve a local Aussie listing, so perhaps this is the neatest way to structure a transaction. What we would end up with here would be a London listed Base business (Copper / Aluminium / Lithium) NewCo, which would likely command a real premium in the market given its exposure to a basket of assets the market loves right now – it would have a wonderful story to tell, being the only asset of scale that gives such exposure without the dilutions of other base assets. Its sister company would be an Australian listed Bulk business (Coal / Iron Ore / Marketing ) which would be a yield-generating company, something likely to be genuinely attractive to local Australian investors. Clearly there are many potential complexities in the sequencing of a merger and demerger as alluded to here – but the market is convinced there is real value to be derived, hence the lack of share price erosion in Rio in London on Friday. As discussed above though, there was debate on whether Rio has learned from BHP’s Anglo parable – maybe the only way to do a deal such as this is to acquire the whole asset and effect whatever disposals necessary post close – there is a genuine possibility that they own the whole of Glencore (ie including coal) for at least some short term going forward. Noone seemed to believe this was a long term proposition though.

The Dual Listed Company

Given the volume of discussion about the creation of an Australian and London structure, very quickly one ends up contemplating the Dual Listed structure of Rio – the question being whether this presents an opportunity to take advantage of this, rather than see it as an impediment to M&A. Despite activist pressure to collapse the structure – Rio has always stressed it would have no need to – it could still issue large amounts of equity for M&A without doing so – something that’s never been tested in a parallel fashion before so no one really knows how this might work. Clearly Rio should want to issue (>20% more valuable) Australian paper – but Glencore and its holders should want to receive the London paper. Maybe there is an intention to offer a blend of both or maybe there is a clever way to splice this into the creation of new local listings for the proforma companies – no one really had any answers to this. The DLC spread tightened (with AU – 6% and LN -3%) on Friday – it will be interesting to see whether this continues in coming days – it could well be that directional Australian investors simply thought Rio would sell off harder in London and now share some value optimism too. But whichever way we cut it, the fate and implications of the DLC structure remain some of the big talking point unknowns.

Potential Premia

The Australian market was awash with speculation of a potential nil-premium transaction – presumably hot on the heels of Anglo/Teck. The clear distinction here should come from the genesis of this transaction – it has been speculated for some time that Glencore is a seller, it would be a huge surprise to see anything other than a decent premium paid. Having said that, with limited synergies on offer, and the transaction needing to be paper based, the discussion in the market swirled around numbers like 15%ish rather than anything more meaningful. Of course with Glencore +10% on Friday, this then led to a wide-ranging discussion about how much was already being baked in – or conversely what value creating would ensure from the creation of NewCo – a circular reference back to the structure questions above (and to some degree the DLC, given the unknown nature of paper issued).

Synergies

There is limited overlap between the asset bases of the companies so the potential for classical synergy derivation isn’t huge, cost benefits will be largely limited to central cost eliminations and revenue benefits will come from the expansion of marketing scale. This isn’t a merger that will be driven by this kind of benefit though – the belief is that it’s an opportunity to reset the structure of the company (or companies) longer term – through the kind of shapes discussed above. We’ve seen synergy numbers like $10bn being thrown around for what that is worth.

Antitrust

Clearly the proforma business (with or without a subsequent break up) would be a real mining giant. Most assume a transaction will take 18-24mo to consummate – but this is seen more as a function of local geographical approvals than anti-trust worries. NewCo will be the largest producer of mined copper, seaborne thermal coal, bauxite and zinc. It will be only behind BHP in Iron Ore volumes and Glencore’s marketing business obviously gives it extra clout in all of these regards. But there really is very limited commodity overlap between the companies, only in copper is there anything meaningful - as we known from Anglo / Teck antitrust processes, these aren’t seen as problematic markets. Noone thinks there is any real anti-trust concern that needs modelling. Of course China approvals will be key, and China plays a much bigger role anyway.

China

One of the more interesting angles for discussion has been China, from multiple perspectives including (1) the Chinalco holding and their potential ability to block a deal through the size of their holding, if one assumes ‘normal’ scheme vote turn out (2) Chinalco’s willingness to see its equity ownership position diluted by the issuance of equity to Glencore shareholders, (3) the political considerations of a China SOE being the largest shareholder in Rio for other Countries that will need to approve any deal and in particular the debate as to what level of influence do they have indirectly even though there are governance structure in place to limit direct influence (3) SAMR and what they may seek to extract from any tie-up in return for their approval – and as an aside to this whether this has any implications for the timetable and outcome of approving the Anglo-Teck combination.

Clearly these are not standalone factors but are all interlinked. We have been told that Chinalco should not be seen as “another shareholder” but a representation of China as a strategic partner and that their investment in Rio therefore is a strategic one rather than a purely financial investment. The former CEO of Rio saw it as a priority for him to spend significant time around this relationship, to ensure it was a productive and positive one and to differentiate the way that China viewed Rio compared to other sector players, including BHP for example. Equally, from a strategic perspective, we understand that internally it has been a priority for Rio to find a way to reduce the percentage ownership holding of Chinalco in Rio, in order to free up head room to the upper ownership level permitted by the Australian government as a condition of Chinalco initially acquiring its stake in Rio, which could enable the Company to undertake purchases of its own shares. We are told that management sees this as the highest returning use of its capital – hence the reports in the past 12 months of Rio exploring options to exchange Chinalco TopCo shares for ownership positions in certain assets.

Before any tie-up is announced, one would expect many of these issues to have been resolved and investors will want any definitive announcement to include an irrevocable intent from Chinalco to vote in favour of the schemes – no one will want a key risk to the scheme vote to be persuading the strategic Chinese investor/largest shareholder of the merits of the proposed deal.

Of course combining with Glencore using equity could help both Rio and China to pursue their own aims. For Rio, the dilution from equity issuance and consequent reduced shareholding of Chinalco in the enlarged group, could create the headroom to facilitate a share buyback using the existing balance sheet capacity and enhanced cash flows of the enlarged group. This buyback could also be a helpful strategy to help to absorb any selling of Rio shares by Glencore shareholders exiting the enlarged group post closure and mitigate any share price impact of any over-supply. Over time a share buyback would accrete Chinalco back to its current permitted shareholding level. Additionally, China may be a potential acquiror of any non-core asset disposals post closure, and could potentially even use Rio shares rather than cash as currency, again creating further buyback headroom. For Chinalco, this is an opportunity to increase its influence by being the strategic investor in the largest global mining company and for China it may seek to extract further benefits as part of the approval process, both in terms of Chinalco’s voting power and SAMR’s approval requirements.

Clearly many complexities here to navigate, but it is for this very type of large M&A scenario that the China/Chinalco relationship has been such a focus for Rio’s senior management. Consequently, we would not be expecting Rio to be pursuing this opportunity at this time unless it was confident that an acceptable ‘package’ could be achieved and that it would have the support and backing of its largest shareholder as well as a path to regulatory approval from SAMR.

Interlopers

Obvioulsy there was much discussion about BHP on Friday too. Given their 11th hour re-approach for Anglo American late last year, the market knows that BHP is trying to solve its own issues via M&A, and is keen on Copper right now. So there will be endless discussion about whether BHP would look to compete for Glencore – they repeatedly told everyone they had moved on from Anglo only to re-emerge when shareholder votes loomed, we know plenty who are unwilling to take BHP’s word for it when they say Glencore isn’t of interest. However – this IS what they say, both the company and those close to it have stressed (both through 2025 and even on Friday) that this wasn’t an interesting situation to them. Glencore’s marketing business is probably eeven less attractive to BHP than to Rio, so its always been fair to say that Rio has always been seen as a better stable-mate for Glencore than BHP – but its unlikely anyone will ever truly rule BHP out. How easy it is to really rule them IN though is a different story – the market’s gut instinct seems to suggest its unlikely in reality.

Conclusion

This was just meant to be a wrap of what we’ve seen being discussed in the market since Thursday night’s newsflow. Many of these topics need plenty more work, particularly the concept of the structure of any transaction. It seems highly unlikely still that Rio is a coal owner in anything other than a very short term structure, but they have probably learned from BHP/Anglo that playing things too cute risks embarrassing failure. We know that they will want to use an opportunity such as this to try and “solve” for the restrictions brought upon them by the Chinalco holding somewhat too. What the Chinese response to this will be is unknown, and presumably the more that is given in this way, the less Australian politicians will like the transaction. How the DLC helps or hinders M&A like this is still a hotly contested talking point. So, still way more questions than answers – but Rio’s performance on Friday was seen as emboldening, the market understands the potential for genuine value creation through this combination.

More as things develop further.

----------------------------------------

Glencore (GLEN LN) / Rio Tinto (RIO LN / RIO AU)The Morning After the Night Before - 9th January 2026

Last night the FT once again reported that Rio Tinto (RIO LN, RIO AU / Market Cap £104bn) and Glencore (GLEN LN /£48bn) are in early stage talks about a combination. Both companies followed this up by issuing identical statements saying that they “have been engaging in preliminary discussions about a possible combination of some or all of their businesses, which could include an all-share merger between Rio Tinto and Glencore. The parties’ current expectation is that any merger transaction would be effected through the acquisition of Glencore by Rio Tinto by way of a Court-sanctioned scheme of arrangement.” Theoretically there is now a 5th February PUSU in play.

This story has been speculated hugely in the market for some time, and obviously comes hot on the heels of Anglo American’s (AAL LN / £37bn) combination with Teck Resources (TECK US / $24bn). Indeed, it was broadly reported almost exactly a year ago that Rio and Glencore were in talks – although we never had any confirmation from the companies so it was assumed that the companies had gone pens down.

Rio Tinto shares traded -6.5% in Australia overnight. After a flurry of excitement last night we just wanted to quickly update pre-London opening with the topics that were being most broadly discussed in the market. We will obviously expand with further thoughts as things develop. Clearly RIO stock will fall quite hard this morning and Glencore will rally nicely. The market will be focused on the topics like we have touched on above: (a) how does RIO avoid buying the assets it doesn’t want, particularly coal – what does this mean the structure of any deal would look like (b) what does this mean for the RIO DLC structure (c) what will BHP make of this – can Glencore, the master negotiators, lure them to the dance or (d) is there risk to Glencore/RIO if the former overplays its hand in this regard? Clearly this would be a long, complicated deal from a regulatory approval perspective, and the presence of Chinalco on Rio’s shareholder register always complicates this picture further. But this has been a story long in the making – its been known that these two dance partners have been flirting for quite some time – one should assume there is a very real chance of a combination finally being consummated here. Quite how that will look structurally is anyone’s guess at this early stage but it does feel this phase of large-scale mining M&A is set to continue. More to follow but these were the talking points:

A Split of Glencore Needed?

Rio Tinto had previously been very M&A shy in recent years before making a move for Arcadium Lithium last year. In keeping with BHP's failed moves on Anglo their main strategic driver is to lower exposure to Iron Ore (and China), something that has been the bedrock of their business for decades. All the large mining companies are trying to think about the best way to do this and position their businesses for the future. GLEN recently bought Teck's coal assets – Rio now making a large acquisition like this and heading back to coal would be an odd move given all their recent messaging to the street about repositioning the business for the future. The Arcadium purchase bought them a somewhat controversial exposure to Lithium at the bottom of the cycle – it was a bold move for a previously conservative management team (which has seen change since) but the accompanying message was clear. This was one leg in their vision of moving the company to new energy source exposures. The Investor Seminar in early December 2024 was a clear reiteration of this – one should observe the slides here where much is made about the repositioning and topics like “Net Zero” and “Energy Transition”. It is worth looking back through these slides through the lens of a large coal transaction, it couldn’t be a less appropriate fit. So it has always been speculated that Glencore should probably be broken into two pieces, Rio could keep the assets it finds attractive whilst finding a solution for the rest (perhaps a spin of an Australian listed NewCo like the creation of South32 (S32 AU / $11bn) a few years ago). It is woth remembering the internal reorganisation that Glencore performed last year where it transferred almost $22 billion in foreign assets into its Australian subsidiary, a move many saw as a forerunner to a large scale M&A deal. All the coal operations are now under the Australian entity, again lending support to the concept that the part Rio wouldn’t find attractive could be demerged as part of a larger transaction. The sequencing here will likely be complicated but then leads on to a question about the RIO Dual Listed Company structure.

This story has been speculated hugely in the market for some time, and obviously comes hot on the heels of Anglo American’s (AAL LN / £37bn) combination with Teck Resources (TECK US / $24bn). Indeed, it was broadly reported almost exactly a year ago that Rio and Glencore were in talks – although we never had any confirmation from the companies so it was assumed that the companies had gone pens down.

Rio Tinto shares traded -6.5% in Australia overnight. After a flurry of excitement last night we just wanted to quickly update pre-London opening with the topics that were being most broadly discussed in the market. We will obviously expand with further thoughts as things develop. Clearly RIO stock will fall quite hard this morning and Glencore will rally nicely. The market will be focused on the topics like we have touched on above: (a) how does RIO avoid buying the assets it doesn’t want, particularly coal – what does this mean the structure of any deal would look like (b) what does this mean for the RIO DLC structure (c) what will BHP make of this – can Glencore, the master negotiators, lure them to the dance or (d) is there risk to Glencore/RIO if the former overplays its hand in this regard? Clearly this would be a long, complicated deal from a regulatory approval perspective, and the presence of Chinalco on Rio’s shareholder register always complicates this picture further. But this has been a story long in the making – its been known that these two dance partners have been flirting for quite some time – one should assume there is a very real chance of a combination finally being consummated here. Quite how that will look structurally is anyone’s guess at this early stage but it does feel this phase of large-scale mining M&A is set to continue. More to follow but these were the talking points:

A Split of Glencore Needed?

Rio Tinto had previously been very M&A shy in recent years before making a move for Arcadium Lithium last year. In keeping with BHP's failed moves on Anglo their main strategic driver is to lower exposure to Iron Ore (and China), something that has been the bedrock of their business for decades. All the large mining companies are trying to think about the best way to do this and position their businesses for the future. GLEN recently bought Teck's coal assets – Rio now making a large acquisition like this and heading back to coal would be an odd move given all their recent messaging to the street about repositioning the business for the future. The Arcadium purchase bought them a somewhat controversial exposure to Lithium at the bottom of the cycle – it was a bold move for a previously conservative management team (which has seen change since) but the accompanying message was clear. This was one leg in their vision of moving the company to new energy source exposures. The Investor Seminar in early December 2024 was a clear reiteration of this – one should observe the slides here where much is made about the repositioning and topics like “Net Zero” and “Energy Transition”. It is worth looking back through these slides through the lens of a large coal transaction, it couldn’t be a less appropriate fit. So it has always been speculated that Glencore should probably be broken into two pieces, Rio could keep the assets it finds attractive whilst finding a solution for the rest (perhaps a spin of an Australian listed NewCo like the creation of South32 (S32 AU / $11bn) a few years ago). It is woth remembering the internal reorganisation that Glencore performed last year where it transferred almost $22 billion in foreign assets into its Australian subsidiary, a move many saw as a forerunner to a large scale M&A deal. All the coal operations are now under the Australian entity, again lending support to the concept that the part Rio wouldn’t find attractive could be demerged as part of a larger transaction. The sequencing here will likely be complicated but then leads on to a question about the RIO Dual Listed Company structure.

Fig 1: RIO / Glencore and Proforma Revenue Split by Commodity (Source: MKI / Bloomberg)

The DLC

There has been much talk in recent years about RIO’s Australian / London Dual Listing structure – with activist pressure on the company to simplify its structure ever since BHP did the same. One of the main reasons cited has always been how cumbersome it makes issuance of equity for M&A. RIO has always been very clear (both to us and to the market) that it doesn’t agree, it doesn’t see it as an issue – but such a big M&A transaction will bring this discussion to the fore again. The spread between the two lines remains >20%. Again – this was being discussed widely last night – often through the lens of a potenail break up of a proforma NewCo to leave a UK and an Australian business – perhaps there is a way to weave this all together.

There has been much talk in recent years about RIO’s Australian / London Dual Listing structure – with activist pressure on the company to simplify its structure ever since BHP did the same. One of the main reasons cited has always been how cumbersome it makes issuance of equity for M&A. RIO has always been very clear (both to us and to the market) that it doesn’t agree, it doesn’t see it as an issue – but such a big M&A transaction will bring this discussion to the fore again. The spread between the two lines remains >20%. Again – this was being discussed widely last night – often through the lens of a potenail break up of a proforma NewCo to leave a UK and an Australian business – perhaps there is a way to weave this all together.

Fig 2: RIO DLC Spread (in %) (Source: MKI / Bloomberg)

Last Night’s Sequencing – A Hint that this is Glencore Leaking to Engineer an auction with BHP?

Having missed out on Anglo American, there has been a lot of questioning about how BHP (BHP US / $162bn) will address its own M&A issues – there are many in the market who feel BHP cannot afford to sit and watch all the other consolidation that is going on. BHP has obviously said repeatedly it doesn’t need to acquire, but there was talk mining circles all last year about Glencore beautifying itself to attract both BHP and RIO, thus hopefully extracting best price in any sale. While Anglo was in play there was obviously no change BHP would have looked at an asset like Glencore, but now that is out of reach (despite trying twice) perhaps their opinion will have changed. The accusations that Glencore are trying to engineer an auction were certainly being made last night with the sequencing of events. Perhaps conspiracy theory but we can touch on this discussion. There are some interesting ways to think about how that UK Panel rules should apply here. The target has to respond to speculation if in receipt and still considering an approach. The statements say "preliminary" and the FT describe as early stage, so that is unlikely to be fully baked like that. So the subtlety should really be that panel rules say it is for Rio as the potential offeror to respond to press speculation. (ie the target may not know about a potential approach so not their job to respond. Particularly pertinent here as its clear there are a number of possible structures being considered - GLEN wouldn't necessarily know this, only RIO should know what structures it may or may not be up for). But, it was GLEN that led the way with a public statement. Why it was them not RIO could be a good question.

One avenue of speculation will be that Glen has leaked and then put out a confirmatory RNS to 'out' Rio by confirming the rumour and cutting off the option of RIO saying to the panel it will down tools for 6 months to enable it to stay silent. ie avoiding what is reputed to have happened last time around. The implication here would be that GLEN really do want to get an auction started. It would not be without risk though. If Glen leaked it and then went against protocol by going first with the RNS in order to deny Rio the opportunity to put pens down that could antagonise Rio in the midst of these relatively early stage negotiations - it's not a hostile act but a quasi reverse bear hug isn't fully friendly either. As an aside - there has been plenty of fuel added to the "GLEN leaked it" fire by the speed at which they responded to the FT. We understand that the journalists approached the parties some 3hrs before writing so perhaps that's unfair - they knew the story was coming so had plenty of time to get a response ready.

Glencore Trading

Clearly one of the sources of value that distinguishes Glencore from its peers is the trading arm, this has always been seen by the market as being problematic when it comes to M&A. Glencore are clearly the most aggressive operator of an asset like this – were it to fall under any other company’s culture, it would likely drive less value than Glencore can extract organically. This probably comes more easily to RIO than BHP but neither will be as aggressive as Glencore itself would be with an asset like this. How does a third party pay a sufficient control premium for this asset therefore. The other debate couples with the concept of a split of Glencore discussed above – if this were to happen, where would the trading business go? Clearly the whole point is to have it vertically integrated with the commodity production pieces, there are dis-synergies in having it arms length. Most of the vertical benefits of trading should be the coal business so there has always been an argument it stays with the coal business in a split scenario, perhaps Glencore management even get to keep running that side of things?

Conclusion

This was just meant to be a quick wrap of the talking points of last nigth before London opens. Clearly RIO stock will fall quite hard this morning (-6% in Australia overnight) and Glencore will rally nicely. The market will be focused on the topics like we have touched on above: (a) how does RIO avoid buying the assets it doesn’t want, particularly coal – what does this mean the structure of any deal would look like (b) what does this mean for the RIO DLC structure (c) what will BHP make of this – can Glencore, the master negotiators, lure them to the dance or (d) is there risk to Glencore/RIO if the former overplays its hand in this regard? Clearly this would be a long, complicated deal from a regulatory approval perspective, and the presence of Chinalco on Rio’s shareholder register always complicates this picture further. But this has been a story long in the making – its been known that these two dance partners have been flirting for quite some time – one should assume there is a very real chance of a combination finally being consummated here. Quite how that will look structurally is anyone’s guess at this early stage but it does feel this phase of large-scale mining M&A is set to continue.

Having missed out on Anglo American, there has been a lot of questioning about how BHP (BHP US / $162bn) will address its own M&A issues – there are many in the market who feel BHP cannot afford to sit and watch all the other consolidation that is going on. BHP has obviously said repeatedly it doesn’t need to acquire, but there was talk mining circles all last year about Glencore beautifying itself to attract both BHP and RIO, thus hopefully extracting best price in any sale. While Anglo was in play there was obviously no change BHP would have looked at an asset like Glencore, but now that is out of reach (despite trying twice) perhaps their opinion will have changed. The accusations that Glencore are trying to engineer an auction were certainly being made last night with the sequencing of events. Perhaps conspiracy theory but we can touch on this discussion. There are some interesting ways to think about how that UK Panel rules should apply here. The target has to respond to speculation if in receipt and still considering an approach. The statements say "preliminary" and the FT describe as early stage, so that is unlikely to be fully baked like that. So the subtlety should really be that panel rules say it is for Rio as the potential offeror to respond to press speculation. (ie the target may not know about a potential approach so not their job to respond. Particularly pertinent here as its clear there are a number of possible structures being considered - GLEN wouldn't necessarily know this, only RIO should know what structures it may or may not be up for). But, it was GLEN that led the way with a public statement. Why it was them not RIO could be a good question.

One avenue of speculation will be that Glen has leaked and then put out a confirmatory RNS to 'out' Rio by confirming the rumour and cutting off the option of RIO saying to the panel it will down tools for 6 months to enable it to stay silent. ie avoiding what is reputed to have happened last time around. The implication here would be that GLEN really do want to get an auction started. It would not be without risk though. If Glen leaked it and then went against protocol by going first with the RNS in order to deny Rio the opportunity to put pens down that could antagonise Rio in the midst of these relatively early stage negotiations - it's not a hostile act but a quasi reverse bear hug isn't fully friendly either. As an aside - there has been plenty of fuel added to the "GLEN leaked it" fire by the speed at which they responded to the FT. We understand that the journalists approached the parties some 3hrs before writing so perhaps that's unfair - they knew the story was coming so had plenty of time to get a response ready.

Glencore Trading

Clearly one of the sources of value that distinguishes Glencore from its peers is the trading arm, this has always been seen by the market as being problematic when it comes to M&A. Glencore are clearly the most aggressive operator of an asset like this – were it to fall under any other company’s culture, it would likely drive less value than Glencore can extract organically. This probably comes more easily to RIO than BHP but neither will be as aggressive as Glencore itself would be with an asset like this. How does a third party pay a sufficient control premium for this asset therefore. The other debate couples with the concept of a split of Glencore discussed above – if this were to happen, where would the trading business go? Clearly the whole point is to have it vertically integrated with the commodity production pieces, there are dis-synergies in having it arms length. Most of the vertical benefits of trading should be the coal business so there has always been an argument it stays with the coal business in a split scenario, perhaps Glencore management even get to keep running that side of things?

Conclusion

This was just meant to be a quick wrap of the talking points of last nigth before London opens. Clearly RIO stock will fall quite hard this morning (-6% in Australia overnight) and Glencore will rally nicely. The market will be focused on the topics like we have touched on above: (a) how does RIO avoid buying the assets it doesn’t want, particularly coal – what does this mean the structure of any deal would look like (b) what does this mean for the RIO DLC structure (c) what will BHP make of this – can Glencore, the master negotiators, lure them to the dance or (d) is there risk to Glencore/RIO if the former overplays its hand in this regard? Clearly this would be a long, complicated deal from a regulatory approval perspective, and the presence of Chinalco on Rio’s shareholder register always complicates this picture further. But this has been a story long in the making – its been known that these two dance partners have been flirting for quite some time – one should assume there is a very real chance of a combination finally being consummated here. Quite how that will look structurally is anyone’s guess at this early stage but it does feel this phase of large-scale mining M&A is set to continue.