Hot on the heels of Friday's Netflix (NFLX US / Market Cap $424bn) bid for Warner Bros Discovery (WBD US / $64bn), Paramount Skydance (PSKY US / $14bn) has just announced a hostile offer, pitched at $30 in cash. It was leaked to the market on Friday that PSKY had made such an offer in private, but that the target had preferred to go with NFLX's $27.75 bid, seemingly on regulatory and financing concerns. However - PSKY has always argued that it didn't get a fair reception from the target - that WBD was always biased to NFLX and is thus taking what it sees as a superior offer direct to target shareholders. It makes the point in its press release that it made 6 proposals in 12 weeks but that "WBD never meaningfully engaged". They give the market more detail on financing than we have had before and of course this gives WBD shareholders certainty over the value of the whole asset - there is no need to debate the value of the Linear Networks spinco that would have been generated by the NFLX bid.

Paramount has pushed hard for this transaction to happen, and heavily criticised Netflix's offer and described the deal as nearly impossible to close. The WBD-Paramount combination was first reported by the WSJ in a scoop on 12 Sept, stating that Paramount was preparing a majority-cash offer for all of WBD. The reporting cadence has been steady. The NYP then reported that, rather than waiting for Skydance, David Zaslav was actively trying to spark a bidding war, meeting GS to sound out Amazon, Apple and Netflix, and was floating an ask “closer to $40/share” ask. On 19 Sept, CNBC’s David Faber put early price talk at $22-$24/share and said a formal proposal could be 70-80% cash with support from Larry Ellison stressing the figures were provisional. Follow-up NYP reporting on 24 Sept said Skydance still hadn’t lodged a formal bid, with the Ellisons and RedBird wary of a hostile move and weighing an approach via John Malone; the piece also said Zaslav had engaged GS to run a two-track process (streaming/studio vs networks) and was dismissive of the $22-$24/share leak as too low. As a further marker of bid prep, Reuters noted on 25 Sept that Paramount Skydance hired former DOJ antitrust lawmaker Makan Delrahim as chief legal officer.

Even before the WSJ stories in Sept, there is history to this story. In Dec 2023, Axios revealed David Zaslav and Bob Bakish met in New York to discuss a possible WBD-Paramount tie-up; Reuters echoed the meeting the next day and added that any mega-deal would likely wait until after April 2024 because of tax constraints tied to WBD’s 2022 formation. Few months later in Feb, Reuters reported WBD had paused those talks and mid-year Skydance struck a two-step agreement to buy control of National Amusements and merge with Paramount. Through 2025, the pieces kept moving for WBD though. On June, WBD formally announced a plan to split into two listed companies (Streaming & Studios and Global Networks) with a target by mid-2026. Then a month later, the US regulators cleared the $8.4bn Paramount-Skydance deal, and on 7 Aug the merger closed, with the combined company debuting as Paramount Skydance (PSKY) under David Ellison.

On 8 Oct, the NYPost reported that David Ellison was in talks with Apollo Global Management to help finance a potential $60bn all-cash bid for WBD, as his father Larry Ellison showed limited appetite for another large media deal so soon after the Paramount close. On 26 November, Reuters' sources said that WBD was seeking to receive improved bids by 1 December, by which date Netflix had already submitted a $27.50/share majority cash offer for WBD studio and streaming, beating Paramount's $30/share offer.

Compared to WBD/NFLX, the flashpoints regarding a WBD/PSKY combination move from streaming dominance to the concepts of studio scale and cable reach. In Washington, the concern will be about a single group controlling a very large slice of US general entertainment, kids and sports networks, with scope to lean on distributors and advertisers and to push prices up. That is the discussion the DOJ will likely want to have about this combination, even if it comes pre-blessed by the White House. California’s focus would be on studios, as a merged studio complex across Burbank and Melrose invites pressure to protect headcount, local production and union bargaining power rather than simply cutting costs. None of this makes the deal impossible, but it sets the stage for a prolonged regulatory review, noisy state politics, and discussions around jobs, channel bundles and sports rather than apps and algorithms - certainly harder than David Ellison laid out on CNBC today. PSKY has now chosen to make public its frustrations with the way WBD has run its auction process and offer more comfort around the underlying financing package it will rely upon. Shareholders will now get the chance to choose which structure they prefer – a straight $30 in cash from PSKY or a $27.75 (with a collar) plus Linear Networks spinco from Netflix. Both proposals bring significant regulatory challenges – both in different areas, all eyes now on how vocal the target wants to be about quite why PSKY’s are that much worse than those of NFLX.

Paramount has pushed hard for this transaction to happen, and heavily criticised Netflix's offer and described the deal as nearly impossible to close. The WBD-Paramount combination was first reported by the WSJ in a scoop on 12 Sept, stating that Paramount was preparing a majority-cash offer for all of WBD. The reporting cadence has been steady. The NYP then reported that, rather than waiting for Skydance, David Zaslav was actively trying to spark a bidding war, meeting GS to sound out Amazon, Apple and Netflix, and was floating an ask “closer to $40/share” ask. On 19 Sept, CNBC’s David Faber put early price talk at $22-$24/share and said a formal proposal could be 70-80% cash with support from Larry Ellison stressing the figures were provisional. Follow-up NYP reporting on 24 Sept said Skydance still hadn’t lodged a formal bid, with the Ellisons and RedBird wary of a hostile move and weighing an approach via John Malone; the piece also said Zaslav had engaged GS to run a two-track process (streaming/studio vs networks) and was dismissive of the $22-$24/share leak as too low. As a further marker of bid prep, Reuters noted on 25 Sept that Paramount Skydance hired former DOJ antitrust lawmaker Makan Delrahim as chief legal officer.

Even before the WSJ stories in Sept, there is history to this story. In Dec 2023, Axios revealed David Zaslav and Bob Bakish met in New York to discuss a possible WBD-Paramount tie-up; Reuters echoed the meeting the next day and added that any mega-deal would likely wait until after April 2024 because of tax constraints tied to WBD’s 2022 formation. Few months later in Feb, Reuters reported WBD had paused those talks and mid-year Skydance struck a two-step agreement to buy control of National Amusements and merge with Paramount. Through 2025, the pieces kept moving for WBD though. On June, WBD formally announced a plan to split into two listed companies (Streaming & Studios and Global Networks) with a target by mid-2026. Then a month later, the US regulators cleared the $8.4bn Paramount-Skydance deal, and on 7 Aug the merger closed, with the combined company debuting as Paramount Skydance (PSKY) under David Ellison.

On 8 Oct, the NYPost reported that David Ellison was in talks with Apollo Global Management to help finance a potential $60bn all-cash bid for WBD, as his father Larry Ellison showed limited appetite for another large media deal so soon after the Paramount close. On 26 November, Reuters' sources said that WBD was seeking to receive improved bids by 1 December, by which date Netflix had already submitted a $27.50/share majority cash offer for WBD studio and streaming, beating Paramount's $30/share offer.

Compared to WBD/NFLX, the flashpoints regarding a WBD/PSKY combination move from streaming dominance to the concepts of studio scale and cable reach. In Washington, the concern will be about a single group controlling a very large slice of US general entertainment, kids and sports networks, with scope to lean on distributors and advertisers and to push prices up. That is the discussion the DOJ will likely want to have about this combination, even if it comes pre-blessed by the White House. California’s focus would be on studios, as a merged studio complex across Burbank and Melrose invites pressure to protect headcount, local production and union bargaining power rather than simply cutting costs. None of this makes the deal impossible, but it sets the stage for a prolonged regulatory review, noisy state politics, and discussions around jobs, channel bundles and sports rather than apps and algorithms - certainly harder than David Ellison laid out on CNBC today. PSKY has now chosen to make public its frustrations with the way WBD has run its auction process and offer more comfort around the underlying financing package it will rely upon. Shareholders will now get the chance to choose which structure they prefer – a straight $30 in cash from PSKY or a $27.75 (with a collar) plus Linear Networks spinco from Netflix. Both proposals bring significant regulatory challenges – both in different areas, all eyes now on how vocal the target wants to be about quite why PSKY’s are that much worse than those of NFLX.

Overview

WBD is a major global media company that integrates TV networks, film/TV production and direct-to-consumer streaming. Its Networks arm (with brands such as TNT, TBS, HGTV, Discovery Channel, TLC, OWN, +CNN and TNT Sports) generated ~$20.2bn in FY24 (51%), with most revenue coming from carriage fees and advertising. Its Studios unit, making ~$11.6bn (30 %), includes Warner Bros. Pictures, DC Studios, TV production, games and branded merchandise, monetised largely via licensing/distribution (~92 % of that segment). The Direct-to-Consumer division pulled in ~$10.3bn (≈26 %) via its streaming platforms Max and discovery+, with ~117mn subscribers globally. Subscription revenue (~87%) dominates, and ad-supported tiers provide upside.

PSKY, born in 2025 from the Paramount Skydance merger, maps neatly into WBD’s framework. Its Networks-type operations include CBS (broadcast and affiliate stations), cable/FTA brands like MTV, Nickelodeon, BET, Paramount Network and Showtime, and international free-to-air outlets such as Channel 5 (UK), Network 10 (Australia) and Telefe (Argentina). CBS News and CBS Sports anchor the news and sports verticals, with rights in NFL, NCAA and UEFA competitions. Its Studios-type assets comprise Paramount Pictures, Paramount Television Studios, Nickelodeon Movies and Skydance’s film/TV/animation units. These support major franchises like Mission: Impossible, Transformers, Star Trek, TMNT and Sonic. In Direct-to-Consumer, PSKY runs Paramount+ (films, series, live news and sport) and Pluto TV (a leading U.S. free streaming service). At closing, Paramount+ had ~77-78m subscribers. PSKY is led by David Ellison, with backing from his father Larry Ellison (Oracle co-founder). Larry Ellison is a longtime Republican donor with close ties to Donald Trump, and reportedly plays a significant behind-the-scenes political role.

Precedents

WBD and Paramount combined control a large mix of cable networks and premium sports rights, selling TV and streaming ads through one bigger sales team. Regulators would worry the merged group could use this scale to raise carriage fees with pay-TV providers, bundle “must-have” channels and sports in deals, and nudge advertisers and viewers towards its own services. The tightest pinch points are general-entertainment and kids’ channels in the US and overseas; premium sports such as NFL/AFC, NCAA March Madness (a CBS–Turner joint venture), UEFA football and the NHL; and ad-supported streaming across Max, Paramount+ and Pluto TV. WBD losing its national NBA rights from 2025/26 softens basketball concerns, but not those in college sport, hockey or the national sports-advertising market.

Regulators would likely distinguish between content supply (channels, sports rights, studios) from downstream distribution (pay-TV, Subscription Videos On Demand (SVOD), etc.), and recognise advertising as a two-sided platform market (viewer attention and advertiser demand). The 2023 U.S. Merger Guidelines explicitly flag platform and multi-sided-market effects; practical share proxies could include audience share, ad-sales share, viewing hours, and value of sports rights.

Based on WBD's and Paramount's 10-K, we analysed the overlap between the companies' reportable segments, and the areas of most concern were "Domestic & International TV Networks" and "Sports". However, News, Digital Sports Brands, Feature-Film Production & Theatrical, and DTC Streaming will see a decrease in competition.

WBD is a major global media company that integrates TV networks, film/TV production and direct-to-consumer streaming. Its Networks arm (with brands such as TNT, TBS, HGTV, Discovery Channel, TLC, OWN, +CNN and TNT Sports) generated ~$20.2bn in FY24 (51%), with most revenue coming from carriage fees and advertising. Its Studios unit, making ~$11.6bn (30 %), includes Warner Bros. Pictures, DC Studios, TV production, games and branded merchandise, monetised largely via licensing/distribution (~92 % of that segment). The Direct-to-Consumer division pulled in ~$10.3bn (≈26 %) via its streaming platforms Max and discovery+, with ~117mn subscribers globally. Subscription revenue (~87%) dominates, and ad-supported tiers provide upside.

PSKY, born in 2025 from the Paramount Skydance merger, maps neatly into WBD’s framework. Its Networks-type operations include CBS (broadcast and affiliate stations), cable/FTA brands like MTV, Nickelodeon, BET, Paramount Network and Showtime, and international free-to-air outlets such as Channel 5 (UK), Network 10 (Australia) and Telefe (Argentina). CBS News and CBS Sports anchor the news and sports verticals, with rights in NFL, NCAA and UEFA competitions. Its Studios-type assets comprise Paramount Pictures, Paramount Television Studios, Nickelodeon Movies and Skydance’s film/TV/animation units. These support major franchises like Mission: Impossible, Transformers, Star Trek, TMNT and Sonic. In Direct-to-Consumer, PSKY runs Paramount+ (films, series, live news and sport) and Pluto TV (a leading U.S. free streaming service). At closing, Paramount+ had ~77-78m subscribers. PSKY is led by David Ellison, with backing from his father Larry Ellison (Oracle co-founder). Larry Ellison is a longtime Republican donor with close ties to Donald Trump, and reportedly plays a significant behind-the-scenes political role.

Precedents

WBD and Paramount combined control a large mix of cable networks and premium sports rights, selling TV and streaming ads through one bigger sales team. Regulators would worry the merged group could use this scale to raise carriage fees with pay-TV providers, bundle “must-have” channels and sports in deals, and nudge advertisers and viewers towards its own services. The tightest pinch points are general-entertainment and kids’ channels in the US and overseas; premium sports such as NFL/AFC, NCAA March Madness (a CBS–Turner joint venture), UEFA football and the NHL; and ad-supported streaming across Max, Paramount+ and Pluto TV. WBD losing its national NBA rights from 2025/26 softens basketball concerns, but not those in college sport, hockey or the national sports-advertising market.

Regulators would likely distinguish between content supply (channels, sports rights, studios) from downstream distribution (pay-TV, Subscription Videos On Demand (SVOD), etc.), and recognise advertising as a two-sided platform market (viewer attention and advertiser demand). The 2023 U.S. Merger Guidelines explicitly flag platform and multi-sided-market effects; practical share proxies could include audience share, ad-sales share, viewing hours, and value of sports rights.

Based on WBD's and Paramount's 10-K, we analysed the overlap between the companies' reportable segments, and the areas of most concern were "Domestic & International TV Networks" and "Sports". However, News, Digital Sports Brands, Feature-Film Production & Theatrical, and DTC Streaming will see a decrease in competition.

- Domestic and International TV Networks: Both WBD and Paramount have considerable presence in general-entertainment and kids space (TNT/TBS/TruTV, Discovery Channel, Cartoon Network/Adult Swim) and Paramount’s Nickelodeon/MTV/Comedy Central/CBS-branded cable, increasing affiliate-fee leverage and ad-sales concentration across linear and CTV. The largest US rivals are: Disney (FX/Freeform/Disney Channel), NBCU (USA/Syfy/Bravo), Fox, AMC, A+E. On an international level: Sky/NBCU, RTL, ITV, TF1/M6, Canal+, Mediaset, ProSiebenSat.1 and regional groups. Distributors still rely on linear reach for mass campaigns, and kids’ brands show high loyalty and stickiness, raising the risk of tying a must-have bundle to broader carriage.

- Sport: On closing, the group would combine CBS/Paramount’s long-term NFL/AFC package (to 2033), UEFA properties on Paramount+ with the Turner/CBS March Madness JV (rights extended to 2032) and TNT Sports’ NHL national package (to 2027-28). WBD’s US national NBA rights fall away from the 2025-26 season, tempering concerns in that sport but not in NCAA/NHL and associated national sports-ad inventory. Rivals include Disney/ESPN/ABC, Fox, NBCU/Peacock, Amazon Prime Video, Apple TV+, and regionally Sky, Canal+, DAZN, beIN, Viaplay. Concerns span: (i) national sports-ad sales concentration; (ii) buyer-power/coordinated effects in the input market for future rights (eg. dampened bid rivalry in NCAA extensions or NHL re-ups); and (iii) consumer distribution via combined sports tiers on Max/Paramount+ and pay-TV carriage leverage. Remedies likely start with ring-fencing the March Madness JV governance and sales, separate sports ad-sales houses, limits on cross-promotion/most-favoured-nation clauses, and, if needed, ceding or sublicensing discrete rights.

- News (CNN vs CBS News/CBSN): The issue here is less about price and more about editorial independence and combined advertising reach. Possible fixes include clear editorial charters, governance firewalls and an independent monitor to prevent interference.

- Digital Sports Brands: (Bleacher Report/House of Highlights vs CBS Sports Digital/Golazo Network/Paramount+ sports hub). YouTube and the digital arms of ESPN, Fox and NBC provide strong competition.

- Feature-Film Production & Theatrical (Warner Bros Pictures/New Line vs Paramount Pictures): This adds to concentration among major studios, but Disney, Universal and Sony remain powerful. Risks relate to output deals, access to talent and theatrical booking.

- Direct-To-Consumer Streaming (Max + Paramount+ and Pluto TV): There is real overlap in general-entertainment subscription and free, ad-supported services, plus a stronger combined sports offering. High churn and the fact that many households subscribe to multiple services soften the risks. Additionally, the DTC streaming space is crowded with competitors (Netflix, Apple TV, Prime Video, etc.), hardly making it one of the areas of biggest concern.

Some of the past precedent examples can be seen below:

- Sky/Comcast (2016): The European Commission cleared Comcast’s acquisition of Sky unconditionally, finding limited horizontal overlap and no material risk of foreclosure despite Comcast’s existing ownership of NBCUniversal. The review focused on potential vertical concerns (whether Comcast could leverage Sky’s distribution in Europe to favour NBCU channels and studios or disadvantage rival content providers) but concluded that Sky’s markets (UK, Ireland, Germany, Italy, and Austria) were competitive and that NBCU’s footprint in wholesale channel supply and film distribution was modest. The EC noted that existing carriage and licensing agreements in these countries already contained non-exclusivity and non-discrimination clauses, reducing the scope for anticompetitive conduct. In the UK, Ofcom also examined media plurality and concluded that Comcast’s acquisition did not raise concerns over control of news or undue influence on the public agenda, given the continued presence of strong competitors such as the BBC, ITV, and Channel 4.

- Comcast/NBCUniversal (2011): The DOJ and FCC cleared Comcast’s purchase of a 51% stake in NBCUniversal, subject to a wide-ranging conduct decree designed to protect rival pay-TV distributors and emerging online video services. The core obligations included licensing NBCU content to online video distributors on fair terms, a binding-arbitration backstop for access disputes, non-discrimination and anti-retaliation rules in programme carriage against other channels, giving up Comcast’s operational oversight in Hulu, and commitments to not slow down or block online video services that competed with NBCU shows. These conditions were time-limited (generally seven years) and monitored to prevent foreclosure through withholding content.

- Disney/21st Century Fox (2019): In the US, DoJ allowed Disney’s acquisition of most Fox assets only after Disney agreed to divest all 22 Fox regional sports networks (RSNs), addressing overlap with ESPN in local sports rights and advertising; the consent decree gave Disney roughly 90 days post-closing to sell, and the RSNs were later sold (mostly) to Sinclair. The EC cleared the deal with conditions requiring Disney to divest its European interests in “factual” A+E channels (e.g., History, H2, Crime+Investigation, Blaze, Lifetime) to avoid weakening competition in the wholesale supply of documentary channels.

- AT&T/Time Warner (2018): DOJ sued to block AT&T’s vertical purchase of Time Warner (Turner, HBO, Warner Bros.), arguing the merged firm could raise programming fees to rival distributors and slow online video competition; the district court rejected the challenge after trial and the DC Circuit affirmed, so the deal closed in the U.S. without remedies. The case shaped subsequent review practice but left no U.S. conduct or divestiture obligations on the parties.

- Discovery/WarnerMedia (AT&T) (2022): In the US, the statutory HSR waiting period expired in February 2022 and the merger proceeded without a DoJ consent decree. In Europe, the EC granted unconditional clearance in December 2021. Several other jurisdictions imposed targeted behavioural safeguards: Mexico’s telecom regulator required, among other things, non-tying and non-discrimination commitments around children’s networks and channel licensing, while Chile’s competition authority accepted commitments preventing discriminatory carriage/bundling and addressing potential conflicts linked to overlapping ownership interests (eg., VTR).

Antitrust

A WBD-Paramount merger would likely face a full Second Request review by the DOJ, focused on the combined leverage in cable networks, sports rights, and ad sales, with remedies likely to mirror Comcast/NBCU-style non-discrimination and targeted sports safeguards, rather than a full block. California poses the heaviest state-level risk given the AG has a history of demanding job, production-floor and labour-market protections (similar to its T-Mobile/Sprint settlement) and could insist on commitments for the Burbank and Melrose lots, union continuity and AI guardrails. In Europe, the EC would probe bundling of kids’ and general-entertainment channels, sports bidding power and ad-sales concentration, and would probably grant conditional Phase I/II clearance subject to behavioural undertakings on carriage, access and governance. Unlike the Netflix offer, overlap in streaming would be limited, making it less of a concern.

A WBD-Paramount merger would likely face a full Second Request review by the DOJ, focused on the combined leverage in cable networks, sports rights, and ad sales, with remedies likely to mirror Comcast/NBCU-style non-discrimination and targeted sports safeguards, rather than a full block. California poses the heaviest state-level risk given the AG has a history of demanding job, production-floor and labour-market protections (similar to its T-Mobile/Sprint settlement) and could insist on commitments for the Burbank and Melrose lots, union continuity and AI guardrails. In Europe, the EC would probe bundling of kids’ and general-entertainment channels, sports bidding power and ad-sales concentration, and would probably grant conditional Phase I/II clearance subject to behavioural undertakings on carriage, access and governance. Unlike the Netflix offer, overlap in streaming would be limited, making it less of a concern.

- DOJ: The Antitrust Division would frame this primarily as a horizontal consolidation across national cable networks and sports rights with vertical elements into streaming and ad-tech, assessed under the 2023 Merger Guidelines’ platform and buyer-power lenses. Expect emphasis on carriage-fee leverage, bundling of “must-have” general-entertainment and kids’ channels, and concentration in national sports advertising, with the NBA issue partially moot given WBD’s loss of national rights from the 2025/26 season. Practical market proxies would include audience and ad-sales share, viewing hours and the value/duration of sports rights. Precedent suggests a conduct-heavy remedy set if cleared: Comcast/NBCU-style non-discrimination and binding-arbitration backstops for carriage and OVD/streaming access; ring-fencing governance and sales around the CBS–Turner March Madness JV; limits on MFNs/cross-promotion; and, if necessary, targeted divestiture or sublicensing of discrete sports packages. Disney/Fox shows the Division will order structural fixes when sports overlaps create local/national ad-sales power; AT&T/Time Warner shows vertical theories can fail in court, but the current Guidelines explicitly highlight multi-sided platforms and competition for inputs (including labour), which strengthens a conduct-plus toolkit here. Base-case is an extended Second Request and a consent decree with behavioural safeguards and targeted sports/ad-sales remedies rather than a full block.

- US States: California is the main risk; the Attorney General can and does pursue merger remedies independently under the Cartwright Act and UCL, and has a track record of extracting state-specific protections even when federal enforcers settle or stand down. In T-Mobile/Sprint, California settled after securing in-state commitments on jobs, pricing and access (explicitly reflecting labour-market harms) illustrating the template the AG could apply to a studio consolidation centred in Los Angeles. For WBD-Paramount, anticipate negotiations around (i) headcount and minimum-production guarantees at the Burbank and Melrose lots, (ii) continued operation and third-party access to stages/post on fair and non-discriminatory terms, (iii) bargaining-unit continuity and neutrality with SAG-AFTRA/IATSE/WGAW, and (iv) data/AI guardrails that protect creative workers. Unions have recently pressed regulators to treat consolidation as a driver of monopsony power, and have supported tougher Merger Guidelines; their public comments would likely bolster the AG’s case for enforceable, monitorable commitments. Politically, Sacramento has just expanded the state’s Film & TV Tax Credit (now moving from $330m to $750m annually through 2030), creating leverage to align any merger approval with job creation and local production floors. If California deems federal conditions insufficient, it could pursue a California-only consent judgment layered on top of any DOJ decree or join multistate litigation.

- European Commission: The EC would assess overlaps in the wholesale supply of pay-TV channels (general-entertainment and kids), premium sports rights, and SVOD/AVOD, typically with member-state granularity and attention to tying/bundling and ad-sales concentration. Discovery/WarnerMedia received unconditional clearance in 2021 because overlaps were limited; a WBD-Paramount combination is materially denser, so a Phase I with commitments (or Phase II) is more likely. Recent international outcomes around the D/WM deal point to the shape of remedies the EC could consider: non-tying/non-bundling obligations for kids and GE channel portfolios; non-discrimination and access for distributors and OTTs; and, where needed, firewalls or separate sales houses for sports/ad inventory. Depending on country-level conditions and sports packages, the Commission could accept targeted behavioural commitments rather than structural divestitures, but it would test coordinated-effects risks in future sports bidding and ad-sales. Base-case: conditional clearance with carriage and ad-sales non-discrimination, anti-tying, and governance ring-fences, drawing on the EC’s prior reasoning and the conduct toolkits seen in other jurisdictions.

Comparing the Two Proposals

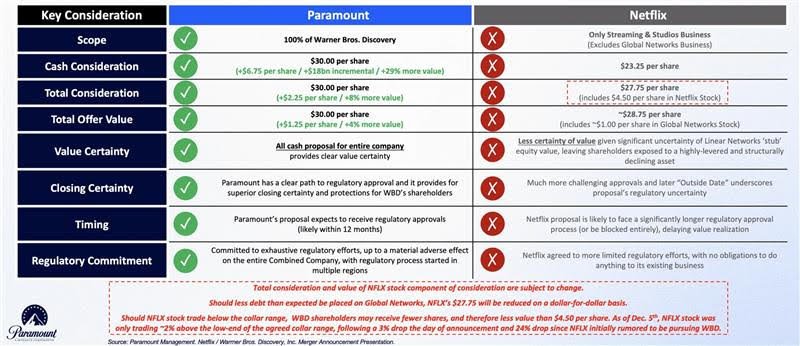

Paramount has launched a microsite for its own offer, in which it compares and contrasts what it thinks are the key advantages for its own proposal over that offered by Netflix. It will, of course, remain to be seen whether WBD shareholders agree with this view, and much will depend on the valuation of the Global Networks business, which was to be spun to shareholders in addition to the Netflix $27.75 (collared) proposal.

Paramount has launched a microsite for its own offer, in which it compares and contrasts what it thinks are the key advantages for its own proposal over that offered by Netflix. It will, of course, remain to be seen whether WBD shareholders agree with this view, and much will depend on the valuation of the Global Networks business, which was to be spun to shareholders in addition to the Netflix $27.75 (collared) proposal.

Fig 1: Comparison of Paramount and Netflix Proposals (Source: PSKY Announcement)

It is of course, worth noting that PSKY is highly incentivised to talk down the value of the Global Networks business, Ellison has been telling CNBC it is worth just $1 per share. There is clearly much yet to be learned about the asset but recent discussion in the market has generally been closer to $2–5 per share, and we’ve heard several investors making the point that the rump is a potentially good fit for a Comcast/Versant-style spin. On top of that, PSKY is likely to face heavier opposition in California than Netflix: labour was the main hurdle for Netflix, whereas PSKY will have to contend with both studio concentration and labour issues.

Conclusion

Compared to WBD/NFLX, the flashpoints regarding a WBD/PSKY combination move from streaming dominance to the concepts of studio scale and cable reach. In Washington, the concern will be about a single group controlling a very large slice of US general entertainment, kids and sports networks, with scope to lean on distributors and advertisers and to push prices up. That is the discussion the DOJ will likely want to have about this combination, even if it comes pre-blessed by the White House. California’s focus would be on studios, as a merged studio complex across Burbank and Melrose invites pressure to protect headcount, local production and union bargaining power rather than simply cutting costs. None of this makes the deal impossible, but it sets the stage for a prolonged regulatory review, noisy state politics, and discussions around jobs, channel bundles and sports rather than apps and algorithms - certainly harder than David Ellison laid out on CNBC today. PSKY has now chosen to make public its frustrations with the way WBD has run its auction process and offer more comfort around the underlying financing package it will rely upon. Shareholders will now get the chance to choose which structure they prefer – a straight $30 in cash from PSKY or a $27.75 (with a collar) plus Linear Networks spinco from Netflix. Both proposals bring significant regulatory challenges – both in different areas, all eyes now on how vocal the target wants to be about quite why PSKY’s are that much worse than those of NFLX.

Conclusion

Compared to WBD/NFLX, the flashpoints regarding a WBD/PSKY combination move from streaming dominance to the concepts of studio scale and cable reach. In Washington, the concern will be about a single group controlling a very large slice of US general entertainment, kids and sports networks, with scope to lean on distributors and advertisers and to push prices up. That is the discussion the DOJ will likely want to have about this combination, even if it comes pre-blessed by the White House. California’s focus would be on studios, as a merged studio complex across Burbank and Melrose invites pressure to protect headcount, local production and union bargaining power rather than simply cutting costs. None of this makes the deal impossible, but it sets the stage for a prolonged regulatory review, noisy state politics, and discussions around jobs, channel bundles and sports rather than apps and algorithms - certainly harder than David Ellison laid out on CNBC today. PSKY has now chosen to make public its frustrations with the way WBD has run its auction process and offer more comfort around the underlying financing package it will rely upon. Shareholders will now get the chance to choose which structure they prefer – a straight $30 in cash from PSKY or a $27.75 (with a collar) plus Linear Networks spinco from Netflix. Both proposals bring significant regulatory challenges – both in different areas, all eyes now on how vocal the target wants to be about quite why PSKY’s are that much worse than those of NFLX.