IBM (IBM US / Market Cap $289bn) has agreed to acquire Confluent (CFLT US / Market Cap $8bn) in a full cash merger. IBM will pay $31 per share in cash, valuing Confluent at an enterprise value of about $11bn. The price implies a premium of roughly 34% to Confluent’s Friday closing price. Closing is expected by mid-2026, subject to a Confluent shareholder vote and customary regulatory approvals, likely to include HSR and EC.

The transaction caps a sale process that has reportedly been in the market since October. Confluent’s Q2 results on 30 July 2025, when management disclosed lost business from a large customer and softened its outlook, triggered a sharp sell-off of roughly 30% and left the shares materially weaker despite the broader AI rally. The stock remained under pressure through late summer, which made the company more exposed to approaches from both financial and strategic buyers.

On 8 October 2025 Reuters reported that Confluent was exploring strategic options, including a potential sale, and that it was working with an investment bank after receiving interest from private equity firms and larger technology groups. The article sparked a bout of takeover speculation, with the shares jumping sharply on the day and trading volumes stepping up as the stock moved into “in-play” territory. The shareholder register today reflects that period, with a mix of global index funds, growth specialists and several hedge funds among the larger holders, but no controlling shareholder. IBM presents the deal as another step in its pivot toward hybrid cloud and AI, adding a specialist data-streaming platform that sits close to the plumbing of modern AI workloads.

IBM and Confluent sit in the same part of the stack and sell similar Kafka-based streaming tools, but the real fight in this market is with AWS, Azure and Google rather than between each other. That context matters as regulators will see a specialist infrastructure player being absorbed into a broader platform, yet still facing heavy competition from the cloud giants and from open source deployments, not a move that tips streaming data into monopoly territory. Any review is therefore less about IBM stopping Confluent from working on AWS, Azure or Google, and more about how IBM uses Confluent inside its own stack. Regulators will ask whether IBM nudges pricing, features or sales so that Confluent mainly serves IBM’s own hybrid cloud and AI products, and whether customers still have solid streaming choices from the hyperscalers and other vendors. Because Confluent software actually runs on the hyperscalers' clouds and their own native streaming tools would stay in place, the antitrust risk, if any, would be a longer reviewing time, rather than a blocking of the deal. The parties guide to closing by mid-2026 - it feels like a "pull and refile" kind of deal.

Overview

Confluent is a pure‑play data‑streaming company; its platform, built around Apache Kafka and Flink, lets customers capture, process and govern data as it is generated rather than in batches. The technology is used across various sectors, including financial services, retail, logistics, and technology, to support real-time customer experiences, analytics, and, increasingly, AI agents. The group makes almost all its money from subscriptions. In 2024, Confluent generated about $964m of revenue, of which 96% came from subscriptions. Within subscriptions, roughly 55% is Confluent Cloud, its fully managed SaaS offering on Amazon (AMZN US / Market Cap $2,450bn)'s AWS, Microsoft (MSFT US / Market Cap $3,590bn)'s Azure and Alphabet (GOOGL US / Market Cap $3,880bn)'s Google Cloud, and about 45% comes from self‑managed Confluent Platform licences and support. Subscription gross margins are high, around the high‑70s, while services are loss‑making, leaving group gross margin at about 73%. The customer base is global, with approximately 60% of revenue coming from the United States and 40% from international markets, with no single country accounting for more than 10%. Confluent positions itself as the “central nervous system” for data in motion inside large enterprises. Growth is tied to three trends: wider enterprise use of streaming architectures, migration to cloud‑native stacks and the need for real‑time data to power machine learning and generative AI.

IBM is a diversified technology group focused on hybrid cloud, AI and consulting. In 2024 it generated around $63bn of revenue, split broadly 43% Software, 33% Consulting and 22% Infrastructure, plus a small financing arm. The Software segment covers hybrid cloud and AI platforms, data and AI, automation and transaction processing, including Red Hat. Consulting provides strategy, technology and operations services, while Infrastructure includes IBM Z mainframes, storage and hybrid infrastructure offerings. IBM is highly global. Roughly half of revenue comes from the Americas, including about 40% from the US, with the balance split between EMEA and Asia Pacific. The company competes with large global software providers such as Microsoft, Oracle (ORCL US / Market Cap $345bn), SAP (SAP GR / Market Cap €260bn), and Salesforce (CRM US / Market Cap $248bn), as well as the hyperscale cloud players, in software and hybrid‑cloud platforms, and with systems integrators like Accenture in consulting. Confluent would sit naturally inside IBM’s Software segment alongside Red Hat and HashiCorp, IBM’s most recent large acquisition. It fills a clear gap in IBM’s data and AI stack by strengthening the data‑streaming layer, where IBM already offers Kafka‑based products such as Red Hat AMQ Streams but is a smaller player. The combination should broaden IBM’s tooling for event‑driven and AI workloads across multiple clouds, while giving Confluent deeper enterprise distribution and consulting support.

The transaction caps a sale process that has reportedly been in the market since October. Confluent’s Q2 results on 30 July 2025, when management disclosed lost business from a large customer and softened its outlook, triggered a sharp sell-off of roughly 30% and left the shares materially weaker despite the broader AI rally. The stock remained under pressure through late summer, which made the company more exposed to approaches from both financial and strategic buyers.

On 8 October 2025 Reuters reported that Confluent was exploring strategic options, including a potential sale, and that it was working with an investment bank after receiving interest from private equity firms and larger technology groups. The article sparked a bout of takeover speculation, with the shares jumping sharply on the day and trading volumes stepping up as the stock moved into “in-play” territory. The shareholder register today reflects that period, with a mix of global index funds, growth specialists and several hedge funds among the larger holders, but no controlling shareholder. IBM presents the deal as another step in its pivot toward hybrid cloud and AI, adding a specialist data-streaming platform that sits close to the plumbing of modern AI workloads.

IBM and Confluent sit in the same part of the stack and sell similar Kafka-based streaming tools, but the real fight in this market is with AWS, Azure and Google rather than between each other. That context matters as regulators will see a specialist infrastructure player being absorbed into a broader platform, yet still facing heavy competition from the cloud giants and from open source deployments, not a move that tips streaming data into monopoly territory. Any review is therefore less about IBM stopping Confluent from working on AWS, Azure or Google, and more about how IBM uses Confluent inside its own stack. Regulators will ask whether IBM nudges pricing, features or sales so that Confluent mainly serves IBM’s own hybrid cloud and AI products, and whether customers still have solid streaming choices from the hyperscalers and other vendors. Because Confluent software actually runs on the hyperscalers' clouds and their own native streaming tools would stay in place, the antitrust risk, if any, would be a longer reviewing time, rather than a blocking of the deal. The parties guide to closing by mid-2026 - it feels like a "pull and refile" kind of deal.

Overview

Confluent is a pure‑play data‑streaming company; its platform, built around Apache Kafka and Flink, lets customers capture, process and govern data as it is generated rather than in batches. The technology is used across various sectors, including financial services, retail, logistics, and technology, to support real-time customer experiences, analytics, and, increasingly, AI agents. The group makes almost all its money from subscriptions. In 2024, Confluent generated about $964m of revenue, of which 96% came from subscriptions. Within subscriptions, roughly 55% is Confluent Cloud, its fully managed SaaS offering on Amazon (AMZN US / Market Cap $2,450bn)'s AWS, Microsoft (MSFT US / Market Cap $3,590bn)'s Azure and Alphabet (GOOGL US / Market Cap $3,880bn)'s Google Cloud, and about 45% comes from self‑managed Confluent Platform licences and support. Subscription gross margins are high, around the high‑70s, while services are loss‑making, leaving group gross margin at about 73%. The customer base is global, with approximately 60% of revenue coming from the United States and 40% from international markets, with no single country accounting for more than 10%. Confluent positions itself as the “central nervous system” for data in motion inside large enterprises. Growth is tied to three trends: wider enterprise use of streaming architectures, migration to cloud‑native stacks and the need for real‑time data to power machine learning and generative AI.

IBM is a diversified technology group focused on hybrid cloud, AI and consulting. In 2024 it generated around $63bn of revenue, split broadly 43% Software, 33% Consulting and 22% Infrastructure, plus a small financing arm. The Software segment covers hybrid cloud and AI platforms, data and AI, automation and transaction processing, including Red Hat. Consulting provides strategy, technology and operations services, while Infrastructure includes IBM Z mainframes, storage and hybrid infrastructure offerings. IBM is highly global. Roughly half of revenue comes from the Americas, including about 40% from the US, with the balance split between EMEA and Asia Pacific. The company competes with large global software providers such as Microsoft, Oracle (ORCL US / Market Cap $345bn), SAP (SAP GR / Market Cap €260bn), and Salesforce (CRM US / Market Cap $248bn), as well as the hyperscale cloud players, in software and hybrid‑cloud platforms, and with systems integrators like Accenture in consulting. Confluent would sit naturally inside IBM’s Software segment alongside Red Hat and HashiCorp, IBM’s most recent large acquisition. It fills a clear gap in IBM’s data and AI stack by strengthening the data‑streaming layer, where IBM already offers Kafka‑based products such as Red Hat AMQ Streams but is a smaller player. The combination should broaden IBM’s tooling for event‑driven and AI workloads across multiple clouds, while giving Confluent deeper enterprise distribution and consulting support.

Fig 1: Confluent as a leader in Streaming Data Platforms, Q4 2025 (Source: Forrester Wave)

IBM Precedent past acquisitions

The closest analogue is IBM’s acquisition of HashiCorp, announced in April 2024 for about $6.4bn of EV. HashiCorp provided infrastructure as code, security, and networking tools for multi-cloud environments, with overlaps in infrastructure automation where IBM and Red Hat already operated. Substantively this is a good precedent because, like Confluent, HashiCorp is a specialised, developer facing infrastructure asset that sits in a strategic layer of the cloud stack, complements IBM’s hybrid cloud and AI strategy, and overlaps with existing IBM and Red Hat tooling without obviously creating dominance. Procedurally it is also instructive: the FTC issued a Second Request in mid-2024, but clearance came after roughly seven to eight months and the deal closed in February 2025 without remedies, while other international regulators (the UK CMA, the German FCO, Austria, and the Australian ACCC) all cleared unconditionally, stressing continued constraints from open source tools and cloud provider alternatives.

The closest analogue is IBM’s acquisition of HashiCorp, announced in April 2024 for about $6.4bn of EV. HashiCorp provided infrastructure as code, security, and networking tools for multi-cloud environments, with overlaps in infrastructure automation where IBM and Red Hat already operated. Substantively this is a good precedent because, like Confluent, HashiCorp is a specialised, developer facing infrastructure asset that sits in a strategic layer of the cloud stack, complements IBM’s hybrid cloud and AI strategy, and overlaps with existing IBM and Red Hat tooling without obviously creating dominance. Procedurally it is also instructive: the FTC issued a Second Request in mid-2024, but clearance came after roughly seven to eight months and the deal closed in February 2025 without remedies, while other international regulators (the UK CMA, the German FCO, Austria, and the Australian ACCC) all cleared unconditionally, stressing continued constraints from open source tools and cloud provider alternatives.

IBM’s 2018 acquisition of Red Hat is the next key reference point. That cash deal at about $34bn EV brought IBM the leading enterprise Linux and Kubernetes platform and effectively anchored its hybrid cloud pivot. Red Hat is a strong precedent for a IBM-Confluent combination because it also involved IBM buying a neutral, open source based infrastructure provider that is widely used across competing clouds and stacks, raising similar questions about whether IBM could or would use the asset to disadvantage rivals. The EC granted unconditional Phase I clearance after finding fragmented application development and system infrastructure markets and continued constraints from Microsoft, Oracle, and others, and the US review, although subject to a Second Request, ended in unconditional clearance after about five and a half months.

Earlier IBM software acquisitions such as SPSS, Cognos, and ILOG were smaller, more traditional analytics and middleware deals that cleared quickly (often with early termination or simple expiry of the HSR waiting period). They pre date the current focus on platforms and data, but they help to confirm the pattern that whenever IBM acquires specialist tools in important infrastructure layers that overlap with its existing stack (HashiCorp, Red Hat, now potentially Confluent), agencies look closely and sometimes issue Second Requests, yet outcomes to date have been unconditional clearances, usually without remedies, against a competitive background that includes strong hyperscaler and open source alternatives.

Overlap and Regulatory Analysis

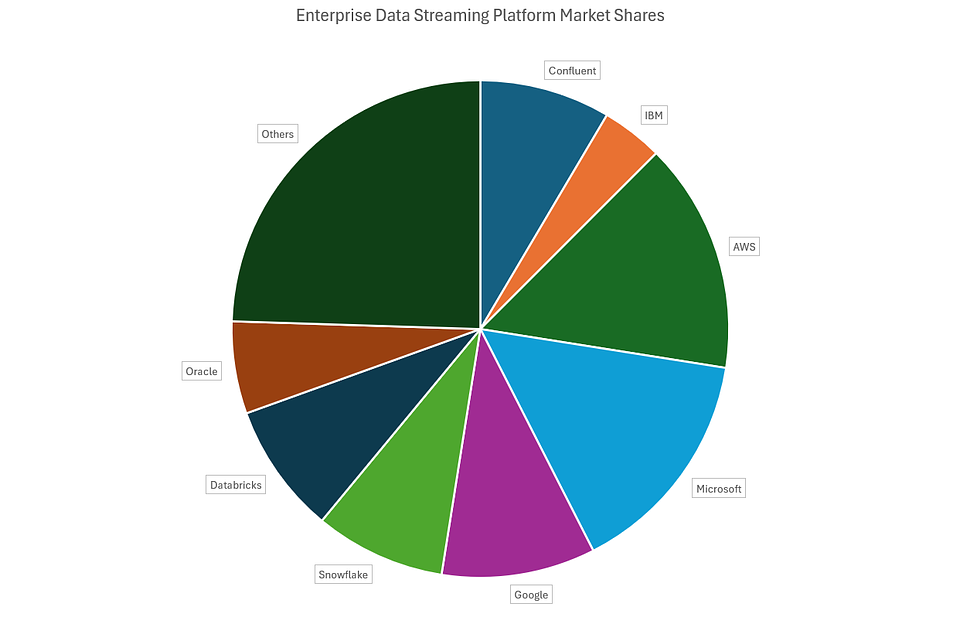

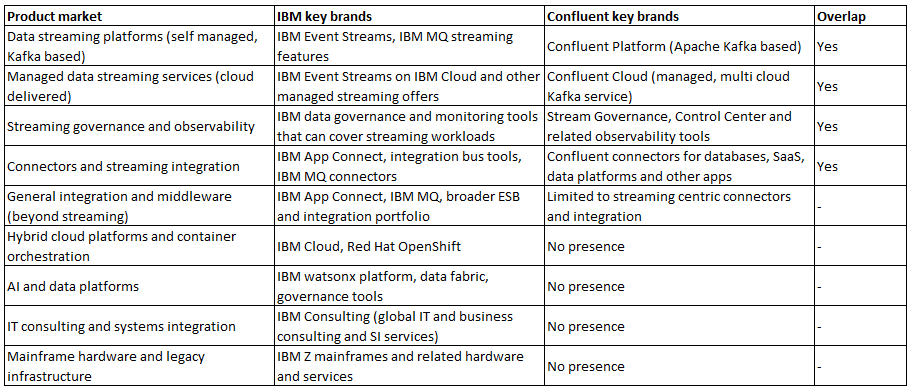

The main horizontal overlap between IBM and Confluent is in enterprise data streaming and streaming-centric integration. Confluent competes with Confluent Platform and Confluent Cloud as Kafka-based streaming backbones, while IBM competes with Event Streams and Red Hat AMQ Streams, plus messaging and integration tools such as IBM MQ and App Connect, that can be configured to solve many of the same "data in motion" problems. As seen in Fig.1, Confluent is consistently described by Forrester as a “Leader” in streaming data platforms, alongside hyperscalers and other data platforms. On any reasonable market view, Confluent likely has a high single-digit share of global streaming-data-platform demand while IBM a smaller single-digit share (for reference, although IBM had been mentioned in the past by Forrester it hasn’t been mentioned in this 4Q25 report). The rest of the market share is split across AWS and Microsoft each in the mid-teens, Google around 10%, Snowflake (SNOW US / Market Cap $76bn) and Databricks (priv.) high single digits each, Oracle mid-single digits, and a long tail of open-source and other vendors. That profile is consistent with IBM and Confluent being genuine substitutes in this layer of the stack, but as two among many options rather than a combined leader.

Earlier IBM software acquisitions such as SPSS, Cognos, and ILOG were smaller, more traditional analytics and middleware deals that cleared quickly (often with early termination or simple expiry of the HSR waiting period). They pre date the current focus on platforms and data, but they help to confirm the pattern that whenever IBM acquires specialist tools in important infrastructure layers that overlap with its existing stack (HashiCorp, Red Hat, now potentially Confluent), agencies look closely and sometimes issue Second Requests, yet outcomes to date have been unconditional clearances, usually without remedies, against a competitive background that includes strong hyperscaler and open source alternatives.

Overlap and Regulatory Analysis

The main horizontal overlap between IBM and Confluent is in enterprise data streaming and streaming-centric integration. Confluent competes with Confluent Platform and Confluent Cloud as Kafka-based streaming backbones, while IBM competes with Event Streams and Red Hat AMQ Streams, plus messaging and integration tools such as IBM MQ and App Connect, that can be configured to solve many of the same "data in motion" problems. As seen in Fig.1, Confluent is consistently described by Forrester as a “Leader” in streaming data platforms, alongside hyperscalers and other data platforms. On any reasonable market view, Confluent likely has a high single-digit share of global streaming-data-platform demand while IBM a smaller single-digit share (for reference, although IBM had been mentioned in the past by Forrester it hasn’t been mentioned in this 4Q25 report). The rest of the market share is split across AWS and Microsoft each in the mid-teens, Google around 10%, Snowflake (SNOW US / Market Cap $76bn) and Databricks (priv.) high single digits each, Oracle mid-single digits, and a long tail of open-source and other vendors. That profile is consistent with IBM and Confluent being genuine substitutes in this layer of the stack, but as two among many options rather than a combined leader.

Fig 2: Enterprise Data Streaming Platform Market Shares (Source: MKI)

Confluent’s 10-K supports that picture. It identifies three main competitor buckets: internal IT teams running open-source Kafka and Flink, cloud-provider managed services such as Amazon MSK, Kinesis and Google Pub/Sub, and "legacy" vendors including TIBCO, Cloudera and Red Hat (owned by IBM) AMQ Streams. That framing explicitly puts Red Hat and IBM in the competitive set for on-premise and legacy Kafka distributions, but also makes clear that the primary commercial pressure on Confluent comes from hyperscaler managed services and from customers’ own open-source deployments, which together plausibly account for well over 50% of addressable demand. By contrast, IBM’s filings position it against other large software and cloud vendors such as Alphabet (Google), Amazon, Microsoft, Oracle, Salesforce and SAP, and do not single out Confluent, which is consistent with IBM’s streaming products representing a relatively small single-digit-share niche inside much larger IBM software and cloud businesses.

There is some extra overlap around streaming governance, observability and connectors, because both IBM and Confluent can offer schema management, monitoring and pre-built connectors between operational systems and downstream analytics or AI tools. However, Confluent’s products in those areas are narrowly focused on Kafka and Confluent Cloud, whereas IBM’s capabilities sit inside a broader integration and data portfolio. Outside this streaming and streaming-centric integration band, IBM’s positions in hybrid cloud, AI platforms and consulting do not have a direct Confluent counterpart and tend to treat Confluent as an input or partner rather than as a head-to-head rival, which underlines that the meaningful horizontal overlap is concentrated in a limited, mid-single-digit-share segment of much larger cloud and software markets.

There is some extra overlap around streaming governance, observability and connectors, because both IBM and Confluent can offer schema management, monitoring and pre-built connectors between operational systems and downstream analytics or AI tools. However, Confluent’s products in those areas are narrowly focused on Kafka and Confluent Cloud, whereas IBM’s capabilities sit inside a broader integration and data portfolio. Outside this streaming and streaming-centric integration band, IBM’s positions in hybrid cloud, AI platforms and consulting do not have a direct Confluent counterpart and tend to treat Confluent as an input or partner rather than as a head-to-head rival, which underlines that the meaningful horizontal overlap is concentrated in a limited, mid-single-digit-share segment of much larger cloud and software markets.

Fig 3: IBM and Confluent Overlap Analysis (Source: Companies Materials)

US

In the US, there seems to be a moderate but manageable antitrust profile. IBM’s HashiCorp deal shows that a second request is possible when it buys specialist infrastructure software, although that case ultimately cleared without remedies. Here the horizontal overlap in Kafka-based streaming looks smaller and structural presumptions are unlikely to be triggered, so the central case is a standard HSR review with some information requests and a chance of a pull-and-refile, rather than a full second request. The agencies are more likely to test vertical and ecosystem theories around streaming as an input to AI and cloud than a pure share-of-market story. Remedies, if any, would be expected to sit in the behavioural bucket, for example commitments on interoperability, multi-cloud neutrality and continued support for open-source tooling, rather than divestitures. Given the strength of hyperscalers and other data platforms, the bar for a litigated challenge or prohibition still looks high, even if policy interest in AI and cloud ensures a visible and politicised review.

European Union

In the EU, the gating question is whether Confluent’s EEA turnover is high enough to trigger a merger review filing. If not, the case would run through national filings with a real possibility of an Article 22 referral pulling it up to Brussels. Either way, this does not look like a concerning horizontal overlap case, on any sensible market definition, IBM and Confluent remain one of several players in streaming and data infrastructure, with hyperscalers and other data platforms much larger. In a worst case scenario, the EC would be more likely to probe vertical and portfolio effects, in particular whether IBM could use control of Confluent to tilt access or performance in favour of its own hybrid cloud and AI stack, but that concern is tempered by the fact that Confluent’s value rests on remaining neutral and multi cloud and by the EC’s existing focus on AWS and Microsoft as the main cloud gatekeepers. Therefore, in the event a filing is required at all, a Phase I clearance is a likely outcome.

UK

The CMA can call in any deal where the target has meaningful UK turnover or where the parties together supply at least about a quarter of a particular category of services in the UK. In HashiCorp/IBM the CMA opened a Phase 1 inquiry at the end of December and cleared the deal unconditionally on 25 February 2025, after a standard 40-working-day review that treated the risk as largely procedural rather than substantive and highlighted the constraining role of open source tools and the hyperscalers on any IBM-HashiCorp overlap. If IBM/Confluent is reviewed, the CMA will likely work along similar lines, testing whether Confluent has a sizeable share of UK demand for enterprise data-streaming and managed Kafka services, how strong the competitive pressure from AWS, Azure, Google Cloud and other data platforms looks in practice, and whether IBM could use ownership of Confluent to tilt those UK customers toward its own hybrid-cloud and AI stack rather than maintaining Confluent as a neutral, multi-cloud provider.

Conclusion

IBM and Confluent sit in the same part of the stack and sell similar Kafka-based streaming tools, but the real fight in this market is with AWS, Azure and Google rather than between each other. That context matters as regulators will see a specialist infrastructure player being absorbed into a broader platform, yet still facing heavy competition from the cloud giants and from open source deployments, not a move that tips streaming data into monopoly territory. Any review is therefore less about IBM stopping Confluent from working on AWS, Azure or Google, and more about how IBM uses Confluent inside its own stack. Regulators will ask whether IBM nudges pricing, features or sales so that Confluent mainly serves IBM’s own hybrid cloud and AI products, and whether customers still have solid streaming choices from the hyperscalers and other vendors. Because Confluent software actually runs on the hyperscalers' clouds and their own native streaming tools would stay in place, the antitrust risk, if any, would be a longer reviewing time, rather than a blocking of the deal. The parties guide to closing by mid-2026 - it feels like a "pull and refile" kind of deal.

In the US, there seems to be a moderate but manageable antitrust profile. IBM’s HashiCorp deal shows that a second request is possible when it buys specialist infrastructure software, although that case ultimately cleared without remedies. Here the horizontal overlap in Kafka-based streaming looks smaller and structural presumptions are unlikely to be triggered, so the central case is a standard HSR review with some information requests and a chance of a pull-and-refile, rather than a full second request. The agencies are more likely to test vertical and ecosystem theories around streaming as an input to AI and cloud than a pure share-of-market story. Remedies, if any, would be expected to sit in the behavioural bucket, for example commitments on interoperability, multi-cloud neutrality and continued support for open-source tooling, rather than divestitures. Given the strength of hyperscalers and other data platforms, the bar for a litigated challenge or prohibition still looks high, even if policy interest in AI and cloud ensures a visible and politicised review.

European Union

In the EU, the gating question is whether Confluent’s EEA turnover is high enough to trigger a merger review filing. If not, the case would run through national filings with a real possibility of an Article 22 referral pulling it up to Brussels. Either way, this does not look like a concerning horizontal overlap case, on any sensible market definition, IBM and Confluent remain one of several players in streaming and data infrastructure, with hyperscalers and other data platforms much larger. In a worst case scenario, the EC would be more likely to probe vertical and portfolio effects, in particular whether IBM could use control of Confluent to tilt access or performance in favour of its own hybrid cloud and AI stack, but that concern is tempered by the fact that Confluent’s value rests on remaining neutral and multi cloud and by the EC’s existing focus on AWS and Microsoft as the main cloud gatekeepers. Therefore, in the event a filing is required at all, a Phase I clearance is a likely outcome.

UK

The CMA can call in any deal where the target has meaningful UK turnover or where the parties together supply at least about a quarter of a particular category of services in the UK. In HashiCorp/IBM the CMA opened a Phase 1 inquiry at the end of December and cleared the deal unconditionally on 25 February 2025, after a standard 40-working-day review that treated the risk as largely procedural rather than substantive and highlighted the constraining role of open source tools and the hyperscalers on any IBM-HashiCorp overlap. If IBM/Confluent is reviewed, the CMA will likely work along similar lines, testing whether Confluent has a sizeable share of UK demand for enterprise data-streaming and managed Kafka services, how strong the competitive pressure from AWS, Azure, Google Cloud and other data platforms looks in practice, and whether IBM could use ownership of Confluent to tilt those UK customers toward its own hybrid-cloud and AI stack rather than maintaining Confluent as a neutral, multi-cloud provider.

Conclusion

IBM and Confluent sit in the same part of the stack and sell similar Kafka-based streaming tools, but the real fight in this market is with AWS, Azure and Google rather than between each other. That context matters as regulators will see a specialist infrastructure player being absorbed into a broader platform, yet still facing heavy competition from the cloud giants and from open source deployments, not a move that tips streaming data into monopoly territory. Any review is therefore less about IBM stopping Confluent from working on AWS, Azure or Google, and more about how IBM uses Confluent inside its own stack. Regulators will ask whether IBM nudges pricing, features or sales so that Confluent mainly serves IBM’s own hybrid cloud and AI products, and whether customers still have solid streaming choices from the hyperscalers and other vendors. Because Confluent software actually runs on the hyperscalers' clouds and their own native streaming tools would stay in place, the antitrust risk, if any, would be a longer reviewing time, rather than a blocking of the deal. The parties guide to closing by mid-2026 - it feels like a "pull and refile" kind of deal.