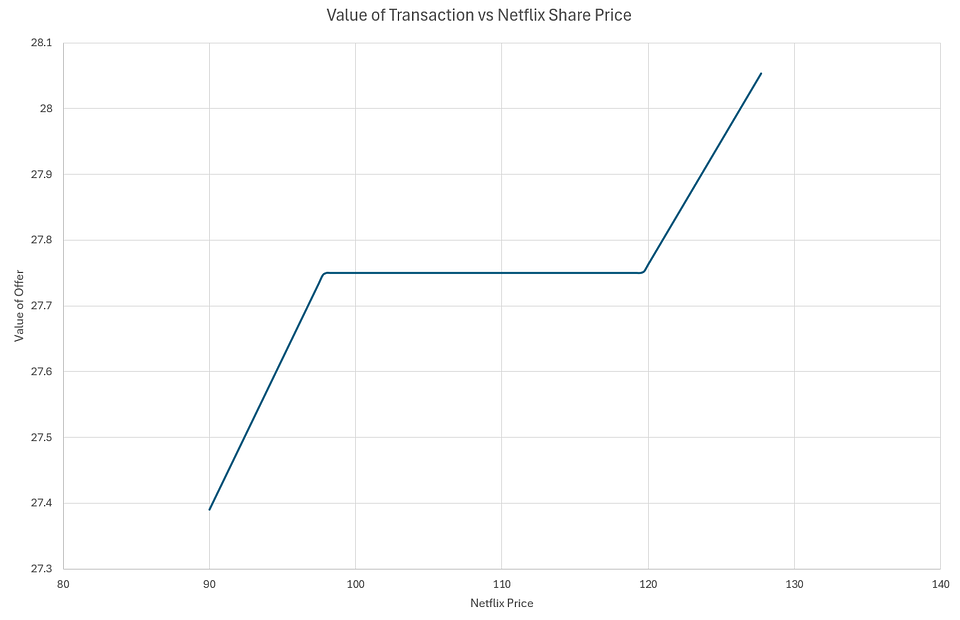

Netflix (NFLX US / Market Cap $437bn) today announced it will acquire Warner Bros. Discovery's (WBD US / $61bn) for $27.75/share in cash and stock in a transaction valued at $83bn EV. Under the agreed terms, each WBD shareholder will receive $23.25/share in cash and $4.50/share if Netflix's 15-day VWAP falls between $97.91/share $119.67/share; otherwise, the stock ratio would be struck at 0.0460x and 0.0376x (see Fig.1 below). The transaction is expected to close in 12-18 months. When it comes to antitrust, the DMA mentions reasonable best effort - the deal is likely to need US HSR, UK CMA and EC clearance.

Fig 1: Value of Transaction vs Netflix Share Price (Source: MKI)

Adding WBD’s Studio and Streaming business gives Netflix a larger flow of premium films and series, reduces hit-rate risk and gives the combined group firmer control over how each title earns through its cycle. The typical life of such films and series can still start in cinemas for WBD releases, move to early digital rental or purchase for tablets (eg. Apple TV, Amazon Prime or Google Play), pass through any remaining pay-TV output deals, and then land inside a unified Netflix-Max subscription and ad-supported window rather than split across competing services.

The rationale for such deal stems from merging two overlapping streaming offers into a single flagship Netflix app or a tight Netflix-HBO Max bundle, with one login, one discovery layer and one advertising system. Netflix would gain leverage by pairing its global reach with WBD’s brands and library, improving negotiations with advertisers and partners, allowing weaker legacy feeds to be phased out over time, and shifting rights and franchises into the platforms and windows that deliver the best returns. Should the deal clear in its original form, it would cut churn and push up market share.

As a way of background, Reuters first reported on 30 October that Netflix had tapped banks to explore a possible offer for WBD, and subsequent trade coverage documented the process of data room diligence, competing suitors and rising offer levels. Bloomberg later reported Netflix submitted a mostly cash proposal in a later bid round and the WSJ described a subsequent majority cash bid, together showing the move from bank engagement and information sharing to a competitive auction and the financing and deal structure that underpin today’s agreement. Other coverage during the period also identified Comcast (CMCSA US / $99bn) and Paramount Skydance (PSKY US / $16bn). For example, following a WSJ scoop on 12 September stating that Paramount was preparing a majority-cash offer for all of WBD, the NYP reported that, rather than waiting for Paramount, David Zaslav was actively trying to spark a bidding war, meeting GS to sound out Amazon (AMZN US / Market Cap $2.5tn), Apple (APPL US / Market Cap $4tn) and Netflix, and was floating an ask “closer to $40/share” ask. On 19 Sept, CNBC’s David Faber put early price talk with Paramount at $22-24/share and said a formal proposal could be 70-80% cash with support from Larry Ellison stressing the figures were provisional. On 26 November, Reuters' sources said that WBD was seeking to receive improved bids by 1 December, by which date Netflix had already submitted a majority cash offer for WBD.

It was reported that Paramount has been warning WBD that a sale to Netflix “would likely never close,” arguing that regulators in the US and abroad will not allow Netflix to add HBO Max and the Warner studio to what it calls Netflix’s “global dominance.” In its letter to WBD’s lawyers, Paramount frames itself as the only bidder without antitrust issues and claims that its own offer provides the “cleanest” regulatory path compared to Netflix and Comcast. Paramount also accuses WBD of abandoning “the semblance and reality of a fair transaction process” and claims the company has run a “myopic process with a predetermined outcome that favours a single bidder”, understood to be Netflix. Paramount also hints at conflicts of interest, suggesting some WBD executives may be influenced by potential roles under new ownership. WBD’s board has pushed back, replying that it is meeting its fiduciary duties and has fully complied with them throughout the sale process. An anonymous group of A-list producers has urged Congress to oppose Netflix’s bid for WBD’s studio and HBO Max, warning it could trigger an “economic and institutional crisis” in Hollywood. They fear Netflix would sharply shorten or scrap theatrical windows, with some insiders citing a possible two-week cinema run before films move to a combined Netflix-HBO Max service. By contrast, Comcast and Paramount are seen as more theatrical-friendly, with Paramount reportedly pledging at least 14 WBD films a year. The letter calls for “highest level” antitrust scrutiny, citing risks to jobs and theatrical filmmaking.

Streaming sits at the centre of the case, and regulators, rival bidders, filmmakers and politicians have already signalled concerns around scale, exclusivity, data and ad power. The review will likely be slow and uncomfortable, but the backdrop is still a crowded market where Disney+, Prime Video, Apple TV+ and others hold real share. The main structural issue sits around HBO Max and, if pressure intensifies, HBO Max or a defined streaming package might have to be sold to cut overlap and make clearance easier. Netflix will pay WBD a termination fee of $5.8bn.

Companies Overview

WBD is a major global media company that integrates TV networks, film/TV production and direct-to-consumer streaming. Its Networks arm (with brands such as TNT, TBS, HGTV, Discovery Channel, TLC, OWN, +CNN and TNT Sports) generated ~$20.2bn in FY24 (51%), with most revenue coming from carriage fees and advertising. Its Studios unit, making ~$11.6bn (30%), includes Warner Bros. Pictures, DC Studios, TV production, games and branded merchandise, monetised largely via licensing/distribution (~92 % of that segment). The Direct-to-Consumer division pulled in ~$10.3bn (~26 %) via its streaming platforms Max and discovery+, with ~117m subscribers globally. Subscription revenue (~87%) dominates, and ad-supported tiers provide upside.

Netflix operates a single global platform that reaches well over 300m subscribers and distributes films, series, documentaries, stand-up, reality formats and growing live events in more than 190 countries. In 2024, out of $39bn revenue generated, 45% came from North America, 32% from EMEA, 12% from Latin America, and the remaining from the Asia-Pacific region. It has no traditional networks or broadcast assets as its focus sits entirely in direct-to-consumer distribution and original production. Its studio operations span Netflix Film, Netflix Television, and animation units such as Animal Logic, producing hits across drama, comedy, YA, action and family categories. The company works with major talent under long-term deals and holds successful franchises including Stranger Things, Squid Game, Knives Out and The Witcher, with an expanding slate of games tied to its IP. In advertising, Netflix launched its ad-supported tier in 2022 and has been building out a unified global ad-tech and sales operation.

Precedents

WBD and Netflix together would control one of the largest pools of premium film and series IP in the market, plus sizable streaming audiences on both sides. WBD brings its Studios and DTC businesses, including Warner Bros. Pictures, DC, HBO Max and discovery+, with 116.9m direct-to-consumer subscribers as of December 2024. Netflix adds a single global streaming service with over 300mn paid memberships in over 190 countries. The merged streaming group would sell advertising across Netflix’s ad tier and WBD’s ad-supported Max and discovery+ products, and could decide whether to keep or withdraw WBD content from third-party platforms.

Regulators would likely distinguish between content supply (studios, Netflix's original products, etc) from downstream distribution (Subscription Video On Demand (SVOD), etc), and recognise advertising as a two-sided platform market (viewer attention and advertiser demand). The 2023 U.S. Merger Guidelines explicitly flag platform and multi-sided-market effects, and practical market share proxies could include audience share, ad-sales share, viewing hours, and value of sports rights. Based on WBD’s and Netflix’s filings, we see the key overlap in global subscription and ad-supported streaming, and in premium scripted and kids’ content. Sports, news and digital sports brands are more about vertical links between WBD’s remaining Networks division and the new Netflix-WBD streaming group than about direct horizontal overlap. Feature film production and theatrical distribution see some increase in concentration, but sizeable rivals remain.

The rationale for such deal stems from merging two overlapping streaming offers into a single flagship Netflix app or a tight Netflix-HBO Max bundle, with one login, one discovery layer and one advertising system. Netflix would gain leverage by pairing its global reach with WBD’s brands and library, improving negotiations with advertisers and partners, allowing weaker legacy feeds to be phased out over time, and shifting rights and franchises into the platforms and windows that deliver the best returns. Should the deal clear in its original form, it would cut churn and push up market share.

As a way of background, Reuters first reported on 30 October that Netflix had tapped banks to explore a possible offer for WBD, and subsequent trade coverage documented the process of data room diligence, competing suitors and rising offer levels. Bloomberg later reported Netflix submitted a mostly cash proposal in a later bid round and the WSJ described a subsequent majority cash bid, together showing the move from bank engagement and information sharing to a competitive auction and the financing and deal structure that underpin today’s agreement. Other coverage during the period also identified Comcast (CMCSA US / $99bn) and Paramount Skydance (PSKY US / $16bn). For example, following a WSJ scoop on 12 September stating that Paramount was preparing a majority-cash offer for all of WBD, the NYP reported that, rather than waiting for Paramount, David Zaslav was actively trying to spark a bidding war, meeting GS to sound out Amazon (AMZN US / Market Cap $2.5tn), Apple (APPL US / Market Cap $4tn) and Netflix, and was floating an ask “closer to $40/share” ask. On 19 Sept, CNBC’s David Faber put early price talk with Paramount at $22-24/share and said a formal proposal could be 70-80% cash with support from Larry Ellison stressing the figures were provisional. On 26 November, Reuters' sources said that WBD was seeking to receive improved bids by 1 December, by which date Netflix had already submitted a majority cash offer for WBD.

It was reported that Paramount has been warning WBD that a sale to Netflix “would likely never close,” arguing that regulators in the US and abroad will not allow Netflix to add HBO Max and the Warner studio to what it calls Netflix’s “global dominance.” In its letter to WBD’s lawyers, Paramount frames itself as the only bidder without antitrust issues and claims that its own offer provides the “cleanest” regulatory path compared to Netflix and Comcast. Paramount also accuses WBD of abandoning “the semblance and reality of a fair transaction process” and claims the company has run a “myopic process with a predetermined outcome that favours a single bidder”, understood to be Netflix. Paramount also hints at conflicts of interest, suggesting some WBD executives may be influenced by potential roles under new ownership. WBD’s board has pushed back, replying that it is meeting its fiduciary duties and has fully complied with them throughout the sale process. An anonymous group of A-list producers has urged Congress to oppose Netflix’s bid for WBD’s studio and HBO Max, warning it could trigger an “economic and institutional crisis” in Hollywood. They fear Netflix would sharply shorten or scrap theatrical windows, with some insiders citing a possible two-week cinema run before films move to a combined Netflix-HBO Max service. By contrast, Comcast and Paramount are seen as more theatrical-friendly, with Paramount reportedly pledging at least 14 WBD films a year. The letter calls for “highest level” antitrust scrutiny, citing risks to jobs and theatrical filmmaking.

Streaming sits at the centre of the case, and regulators, rival bidders, filmmakers and politicians have already signalled concerns around scale, exclusivity, data and ad power. The review will likely be slow and uncomfortable, but the backdrop is still a crowded market where Disney+, Prime Video, Apple TV+ and others hold real share. The main structural issue sits around HBO Max and, if pressure intensifies, HBO Max or a defined streaming package might have to be sold to cut overlap and make clearance easier. Netflix will pay WBD a termination fee of $5.8bn.

Companies Overview

WBD is a major global media company that integrates TV networks, film/TV production and direct-to-consumer streaming. Its Networks arm (with brands such as TNT, TBS, HGTV, Discovery Channel, TLC, OWN, +CNN and TNT Sports) generated ~$20.2bn in FY24 (51%), with most revenue coming from carriage fees and advertising. Its Studios unit, making ~$11.6bn (30%), includes Warner Bros. Pictures, DC Studios, TV production, games and branded merchandise, monetised largely via licensing/distribution (~92 % of that segment). The Direct-to-Consumer division pulled in ~$10.3bn (~26 %) via its streaming platforms Max and discovery+, with ~117m subscribers globally. Subscription revenue (~87%) dominates, and ad-supported tiers provide upside.

Netflix operates a single global platform that reaches well over 300m subscribers and distributes films, series, documentaries, stand-up, reality formats and growing live events in more than 190 countries. In 2024, out of $39bn revenue generated, 45% came from North America, 32% from EMEA, 12% from Latin America, and the remaining from the Asia-Pacific region. It has no traditional networks or broadcast assets as its focus sits entirely in direct-to-consumer distribution and original production. Its studio operations span Netflix Film, Netflix Television, and animation units such as Animal Logic, producing hits across drama, comedy, YA, action and family categories. The company works with major talent under long-term deals and holds successful franchises including Stranger Things, Squid Game, Knives Out and The Witcher, with an expanding slate of games tied to its IP. In advertising, Netflix launched its ad-supported tier in 2022 and has been building out a unified global ad-tech and sales operation.

Precedents

WBD and Netflix together would control one of the largest pools of premium film and series IP in the market, plus sizable streaming audiences on both sides. WBD brings its Studios and DTC businesses, including Warner Bros. Pictures, DC, HBO Max and discovery+, with 116.9m direct-to-consumer subscribers as of December 2024. Netflix adds a single global streaming service with over 300mn paid memberships in over 190 countries. The merged streaming group would sell advertising across Netflix’s ad tier and WBD’s ad-supported Max and discovery+ products, and could decide whether to keep or withdraw WBD content from third-party platforms.

Regulators would likely distinguish between content supply (studios, Netflix's original products, etc) from downstream distribution (Subscription Video On Demand (SVOD), etc), and recognise advertising as a two-sided platform market (viewer attention and advertiser demand). The 2023 U.S. Merger Guidelines explicitly flag platform and multi-sided-market effects, and practical market share proxies could include audience share, ad-sales share, viewing hours, and value of sports rights. Based on WBD’s and Netflix’s filings, we see the key overlap in global subscription and ad-supported streaming, and in premium scripted and kids’ content. Sports, news and digital sports brands are more about vertical links between WBD’s remaining Networks division and the new Netflix-WBD streaming group than about direct horizontal overlap. Feature film production and theatrical distribution see some increase in concentration, but sizeable rivals remain.

- Sport: Most major sports rights, including NBA, MLB, NHL and the NCAA Tournament, are held by TNT Sports inside WBD’s Networks segment, though many events already stream on discovery+ and Max. Netflix has begun to buy selective live rights and events, but is still a small sports player compared with ESPN, Fox, NBCU and Amazon. The main question here is whether a larger Netflix-Max streaming offer could gain an edge in future bidding rounds or in selling national sports advertising, even if TNT Sports remains legally separate.

- Digital Sports Brands: Bleacher Report, House of Highlights and other TNT Sports digital brands remain with WBD’s Networks arm. Netflix’s own sports and documentary brands are much smaller. YouTube, ESPN’s digital sites, and social platforms still dominate this space, so the deal changes little in terms of digital sports competition.

- Feature-Film Production & Theatrical (Warner Bros vs Netflix film studio): Here the deal creates clearer horizontal overlap. WBD’s Studios segment spans Warner Bros. Motion Picture Group, DC Studios, Warner Bros. Television Group and games, plus global content sales and home entertainment. Netflix has built a large in-house film and TV production slate, but has so far relied more on direct-to-streaming and limited theatrical runs. The combined group would be a very large buyer of talent and projects, with control over a deep library of franchises, although Disney, Universal and Sony remain major studio competitors. Concerns here focus on access to talent, output deals and theatrical booking, and on whether independent cinemas and rival streamers can still get strong titles.

- Direct-To-Consumer Streaming (Max + Netflix): This is the core antitrust issue. WBD’s Max and discovery+ plus HBO’s premium services sit inside the DTC segment, with 116.9m subscribers and a plan to keep expanding in 2025 and 2026. Netflix operates a single global streaming segment, draws almost all revenue from monthly membership fees, and now also earns some advertising and live-event income. Together they would form by far the largest global streaming platform by paid memberships, with a powerful mix of HBO Max, Warner Bros and DC IP layered on to Netflix’s existing catalogue. Regulators will ask whether this scale lets the group push more content into exclusive windows, bundle must-have franchises on one app, and gain too much leverage in ad-sales and device or ISP distribution deals. High churn, multi-homing and strong rivals such as Disney+, Prime Video and Apple TV+ still matter here, but this is where any remedy set is likely to bite.

Some of the past precedents are shown below:

- Sky/Comcast (2016): The European Commission cleared Comcast’s acquisition of Sky unconditionally, finding limited horizontal overlap and no material risk of foreclosure despite Comcast’s existing ownership of NBCUniversal. The review focused on potential vertical concerns (whether Comcast could leverage Sky’s distribution in Europe to favour NBCU channels and studios or disadvantage rival content providers) but concluded that Sky’s markets (UK, Ireland, Germany, Italy, and Austria) were competitive and that NBCU’s footprint in wholesale channel supply and film distribution was modest. The EC noted that existing carriage and licensing agreements in these countries already contained non-exclusivity and non-discrimination clauses, reducing the scope for anticompetitive conduct. In the UK, Ofcom also examined media plurality and concluded that Comcast’s acquisition did not raise concerns over control of news or undue influence on the public agenda, given the continued presence of strong competitors such as the BBC, ITV, and Channel 4.

- Comcast/NBCUniversal (2011): The DOJ and FCC cleared Comcast’s purchase of a 51% stake in NBCUniversal, subject to a wide-ranging conduct decree designed to protect rival pay-TV distributors and emerging online video services. The core obligations included licensing NBCU content to online video distributors on fair terms, a binding-arbitration backstop for access disputes, non-discrimination and anti-retaliation rules in programme carriage against other channels, giving up Comcast’s operational oversight in Hulu, and commitments to not slow down or block online video services that competed with NBCU shows. These conditions were time-limited (generally seven years) and monitored to prevent foreclosure through withholding content.

- Disney/21st Century Fox (2019): In the US, DOJ allowed Disney’s acquisition of most Fox assets only after Disney agreed to divest all 22 Fox regional sports networks (RSNs), addressing overlap with ESPN in local sports rights and advertising; the consent decree gave Disney roughly 90 days post-closing to sell, and the RSNs were later sold (mostly) to Sinclair. The EC cleared the deal with conditions requiring Disney to divest its European interests in “factual” A+E channels (e.g., History, H2, Crime+Investigation, Blaze, Lifetime) to avoid weakening competition in the wholesale supply of documentary channels.

- AT&T/Time Warner (2018): DOJ sued to block AT&T’s vertical purchase of Time Warner (Turner, HBO, Warner Bros.), arguing the merged firm could raise programming fees to rival distributors and slow online video competition; the district court rejected the challenge after trial and the DC Circuit affirmed, so the deal closed in the U.S. without remedies. The case shaped subsequent review practice but left no U.S. conduct or divestiture obligations on the parties.

- Discovery/WarnerMedia (AT&T) (2022): In the US, the HSR waiting period expired in February 2022 and the merger proceeded without a DOJ consent decree. In Europe, the EC granted unconditional clearance in December 2021. Several other jurisdictions imposed targeted behavioural safeguards: Mexico’s telecom regulator required, among other things, non-tying and non-discrimination commitments around children’s networks and channel licensing, while Chile’s competition authority accepted commitments preventing discriminatory carriage/bundling and addressing potential conflicts linked to overlapping ownership interests (eg., VTR).

Overlap and Antitrust

A Netflix-WBD studio and streaming deal would draw scrutiny from regulators. The focus would be on streaming scale, control of HBO Max, and data and advertising power, rather than studio. Netflix has only one studio in Albuquerque (NM). However, the streaming giant is currently building a $1bn studio in New Jersey. WBD has multiple studios globally scattered around California, UK, New York, Georgia, Japan, and other countries. Due to limited studio overlap, the conversations we had suggested in this area of the business wouldn't pose a huge threat to the deal.

The real question is whether combining Netflix and HBO Max reduces choice or raises prices in subscription and ad-supported streaming. As mentioned earlier, Paramount has been very critical of the deal and has been warning WBD that a sale to Netflix would be unlikely to close arguing regulators will not let Netflix bolt HBO Max and the Warner studio onto what it calls Netflix’s global dominance. Paramount believes it is the only bidder without antitrust issues and offers the cleanest path to clearance versus Netflix and Comcast. Additionally, an anonymous letter sent by a group of A-list film producers has urged members of Congress to oppose Netflix’s bid for WBD’s studio and HBO Max business, warning it could trigger an “economic and institutional crisis” in Hollywood. They argue that if Netflix controls WBD the company could sharply shorten or scrap theatrical windows for major releases, with some insiders claiming a two-week cinema run before titles move to a combined Netflix-HBO Max service, although others say the window would be longer. By contrast, they note that rival bidders Comcast and Paramount both operate established theatrical studios, with Paramount said to have promised at least 14 WBD films a year for cinemas. The letter says letting Netflix absorb Warner would give it “a noose around the theatrical marketplace”, squeeze downstream licensing fees and reinforce a strategy that CEO Ted Sarandos has previously described as not being in the business of driving people to theatres. The producers call on Congress to oppose the deal publicly and insist it faces the “highest level of antitrust scrutiny,” arguing that millions of jobs and the future of theatrical filmmaking are at stake.

The opposing argument is that streaming markets remain crowded, with Disney+, Prime Video, Apple TV+ and others all holding meaningful share and many homes subscribing to more than one service. To avoid a prolonged review, Netflix may opt to sell HBO Max to a strategic buyer - based on our conversations, Comcast is seen as a good candidate. HBO Max is a great asset, with 130mn subscribers and forecasted $1.8bn EBITDA in 2026, that analysts already see as a standalone prize, which means it could be divested or spun off if regulators insisted on structural remedies.

DOJ: The DOJ would frame this mainly as a platform deal in subscription and ad-supported streaming. Questions will inevitably be around subscriber share in the US, viewing time, ad-sales reach and spend on content. According to the WSJ, Officials have already flagged concerns about a Netflix acquisition of WBD, including the impact on HBO Max, and the White House has discussed the antitrust angles - these concerns were confirmed during our recent trip to DC as well. The antitrust division would test whether Netflix could make HBO and Warner Bros series largely exclusive, raise licensing costs for rivals, or use its algorithms and ad-tech to favour its own services. Precedents point towards a remedy package rather than a block such as: non-discrimination and fair-dealing rules for licensing WBD output to third-party streamers and pay-TV partners, commitments around data use and self-preferencing, and possibly time-limited obligations to keep key HBO and Warner titles available on other platforms. If those measures were not judged enough, the sale of WBD's streaming business is a logical structural fix, since it is already defined and has been described as the core asset that many buyers would want to own. This would drastically reduce any competition concerns due to Netflix's limited presence in Studio.

European Commission: In Europe, the EC would look at horizontal overlap in SVOD and AVOD, and at vertical effects between WBD’s content supply (HBO and Warner Bros series and films) and Netflix’s distribution scale. WBD’s linear channels and most sports rights remain outside the deal, so this is not a classic pay-TV bundling case. The combined service would still face strong regional and global rivals such as Disney+, Prime Video, Apple TV+, local broadcasters and telecom-backed platforms, which helps on the market-power question. Even so, Brussels is likely to test whether Netflix could withhold HBO and Warner Bros content from European broadcasters and streamers, or bundle that content on exclusive terms with its own app. Netflix's large presence and dominant position may raise eyebrows in Bruxelles - if behavioural remedies were not enough, an HBO divestiture package would be a straight forward solution, similarly to the antitrust review in the US. Beyond classic antitrust, the deal triggers the FSR, national FDI reviews and could require media plurality checks under the new EU Media Freedom Act.

Conclusion

Streaming sits at the centre of the case, and regulators, rival bidders, filmmakers and politicians have already signalled concerns around scale, exclusivity, data and ad power. The review will likely be slow and uncomfortable, but the backdrop is still a crowded market where Disney+, Prime Video, Apple TV+ and others hold real share. The main structural issue sits around HBO and, if pressure intensifies, HBO or a defined streaming package might have to be sold to cut overlap and make clearance easier. Netflix’s decision to match Paramount’s proposed $5bn break fee only makes sense if management sees a realistic path through DoJ and EC scrutiny, even if that eventually involves targeted remedies and divestiture.

A Netflix-WBD studio and streaming deal would draw scrutiny from regulators. The focus would be on streaming scale, control of HBO Max, and data and advertising power, rather than studio. Netflix has only one studio in Albuquerque (NM). However, the streaming giant is currently building a $1bn studio in New Jersey. WBD has multiple studios globally scattered around California, UK, New York, Georgia, Japan, and other countries. Due to limited studio overlap, the conversations we had suggested in this area of the business wouldn't pose a huge threat to the deal.

The real question is whether combining Netflix and HBO Max reduces choice or raises prices in subscription and ad-supported streaming. As mentioned earlier, Paramount has been very critical of the deal and has been warning WBD that a sale to Netflix would be unlikely to close arguing regulators will not let Netflix bolt HBO Max and the Warner studio onto what it calls Netflix’s global dominance. Paramount believes it is the only bidder without antitrust issues and offers the cleanest path to clearance versus Netflix and Comcast. Additionally, an anonymous letter sent by a group of A-list film producers has urged members of Congress to oppose Netflix’s bid for WBD’s studio and HBO Max business, warning it could trigger an “economic and institutional crisis” in Hollywood. They argue that if Netflix controls WBD the company could sharply shorten or scrap theatrical windows for major releases, with some insiders claiming a two-week cinema run before titles move to a combined Netflix-HBO Max service, although others say the window would be longer. By contrast, they note that rival bidders Comcast and Paramount both operate established theatrical studios, with Paramount said to have promised at least 14 WBD films a year for cinemas. The letter says letting Netflix absorb Warner would give it “a noose around the theatrical marketplace”, squeeze downstream licensing fees and reinforce a strategy that CEO Ted Sarandos has previously described as not being in the business of driving people to theatres. The producers call on Congress to oppose the deal publicly and insist it faces the “highest level of antitrust scrutiny,” arguing that millions of jobs and the future of theatrical filmmaking are at stake.

The opposing argument is that streaming markets remain crowded, with Disney+, Prime Video, Apple TV+ and others all holding meaningful share and many homes subscribing to more than one service. To avoid a prolonged review, Netflix may opt to sell HBO Max to a strategic buyer - based on our conversations, Comcast is seen as a good candidate. HBO Max is a great asset, with 130mn subscribers and forecasted $1.8bn EBITDA in 2026, that analysts already see as a standalone prize, which means it could be divested or spun off if regulators insisted on structural remedies.

DOJ: The DOJ would frame this mainly as a platform deal in subscription and ad-supported streaming. Questions will inevitably be around subscriber share in the US, viewing time, ad-sales reach and spend on content. According to the WSJ, Officials have already flagged concerns about a Netflix acquisition of WBD, including the impact on HBO Max, and the White House has discussed the antitrust angles - these concerns were confirmed during our recent trip to DC as well. The antitrust division would test whether Netflix could make HBO and Warner Bros series largely exclusive, raise licensing costs for rivals, or use its algorithms and ad-tech to favour its own services. Precedents point towards a remedy package rather than a block such as: non-discrimination and fair-dealing rules for licensing WBD output to third-party streamers and pay-TV partners, commitments around data use and self-preferencing, and possibly time-limited obligations to keep key HBO and Warner titles available on other platforms. If those measures were not judged enough, the sale of WBD's streaming business is a logical structural fix, since it is already defined and has been described as the core asset that many buyers would want to own. This would drastically reduce any competition concerns due to Netflix's limited presence in Studio.

European Commission: In Europe, the EC would look at horizontal overlap in SVOD and AVOD, and at vertical effects between WBD’s content supply (HBO and Warner Bros series and films) and Netflix’s distribution scale. WBD’s linear channels and most sports rights remain outside the deal, so this is not a classic pay-TV bundling case. The combined service would still face strong regional and global rivals such as Disney+, Prime Video, Apple TV+, local broadcasters and telecom-backed platforms, which helps on the market-power question. Even so, Brussels is likely to test whether Netflix could withhold HBO and Warner Bros content from European broadcasters and streamers, or bundle that content on exclusive terms with its own app. Netflix's large presence and dominant position may raise eyebrows in Bruxelles - if behavioural remedies were not enough, an HBO divestiture package would be a straight forward solution, similarly to the antitrust review in the US. Beyond classic antitrust, the deal triggers the FSR, national FDI reviews and could require media plurality checks under the new EU Media Freedom Act.

Conclusion

Streaming sits at the centre of the case, and regulators, rival bidders, filmmakers and politicians have already signalled concerns around scale, exclusivity, data and ad power. The review will likely be slow and uncomfortable, but the backdrop is still a crowded market where Disney+, Prime Video, Apple TV+ and others hold real share. The main structural issue sits around HBO and, if pressure intensifies, HBO or a defined streaming package might have to be sold to cut overlap and make clearance easier. Netflix’s decision to match Paramount’s proposed $5bn break fee only makes sense if management sees a realistic path through DoJ and EC scrutiny, even if that eventually involves targeted remedies and divestiture.