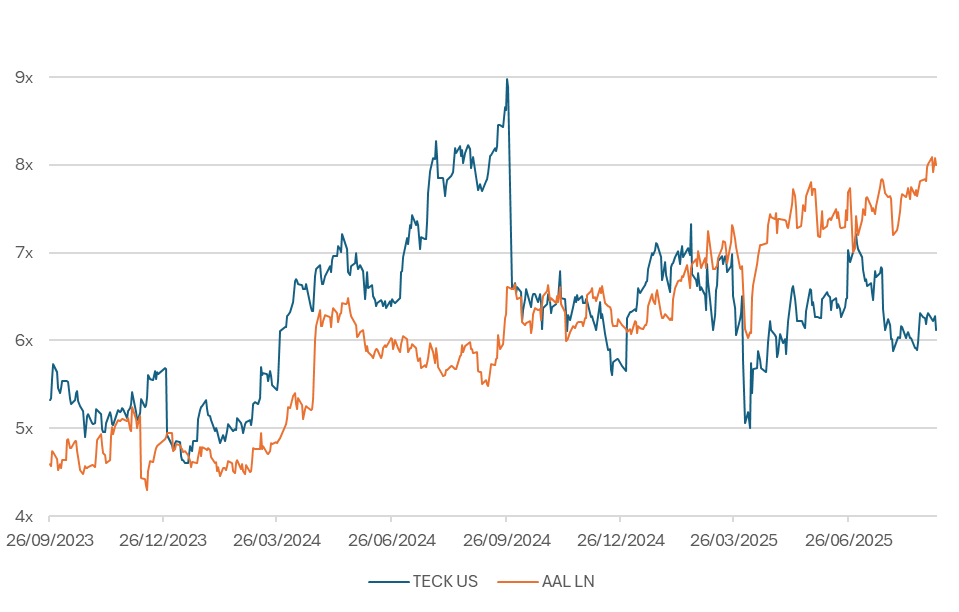

26th September 2025 - Since the announcement on September 9th of Anglo American PLC (AAL LN / Market Cap £32bn) and Teck Resources Ltd (TECK US / Market Cap $20bn)’s intention to combine through a merger of equals, we have been heavily engaged with stakeholders, so we thought it would be timely to update on the key areas of feedback and points of debate in the past two weeks. In summary, the strategic logic of the combination to create a copper-focused mining company is well understood. However, there is an underlying question of whether this is actually more of a defensive move by both parties against the pressures that they find themselves confronting. Overall, the structure of the combination is seen as a better outcome for Anglo than Teck, but it has merits for both. The key questions raised by Teck shareholders are around the rationale for the timing and for accepting a nil-premium proposal at a time when the Teck valuation is at its recent lows whilst Anglo’s is at recent highs (see Fig 1 below). This disparity in multiples therefore gives rise to Teck shareholders owning a smaller portion of the equity of the enlarged group than might otherwise have been expected based on historic contribution ratios.

Fig 1: Anglo and Teck 1-Year Forward EV/EBITDA Multiple Since September 2023 (Source: Bloomberg)

In terms of completion risks, the two main risks that have been the focus of our discussions and that we address in turn are:

- Canadian regulatory approval via the Investment Canada Act

- Competing offers

- Canadian regulatory approval via the Investment Canada Act

- Competing offers

Defence Is The Best Form Of Attack

A common theme in the investor dialogue has been the degree to which this is a defensive merger for both parties. From an Anglo perspective, they are widely praised for taking advantage of their more highly valued paper to increase their copper exposure when Teck’s valuation is at a significant discount and create a copper-focused company that should, based on current trends, receive a premium rating. More broadly though, it is also seen as a defensive move against a possible return by BHP Group Limited (BHP AU / Market Cap $140bn) after their failed approaches last year and a way to be seen as being on the front foot strategically following the platinum divestiture, diverting attention away from the slower progress around the disposals of the coal, diamonds and nickel assets, which now become smaller parts of the enlarged group on a look-through basis.

From a valuation perspective, the recommendation of the nil-premium proposal from Anglo by the Teck board has raised a series of questions for investors, particularly around the timing – most notably, “why now”, when the company is still in the midst of addressing issues with the QB project and having only just announced on September 2nd a Comprehensive Operations Review and QB Action Plan, which is expected to lead to updated guidance from the company in Q4. The inference for some investors has been that the QB project is going to take longer and cost more to complete and ramp up than previously expected. Therefore, with management and the board under pressure, with potentially more bad news to come and with it being unlikely that there is going to be an imminent positive catalyst for a re-rating, the board have seen this nil-premium offer as an attractive way of countering the negative newsflow by refocusing the narrative on the positives of combining the two companies, including bringing on board the significant expertise and experience of Anglo to the QB project.

Unsurprisingly, this line of debate has led to questions from Anglo investors around the DD undertaken on QB and seeking reassurance on the quality of the QB asset. In this regard, Anglo management has been reiterating the extensive in-house and external review work they have done to get comfortable with QB, and that the issues currently being encountered around the sand drainage issues at QB are very similar to what they encountered and addressed when they brought on stream and developed their own Quellaveco project.

Teck’s CEO has also talked about the timing rationale and nil-premium being justified by the ability to access the QB/Collahuasi unitisation benefits sooner than otherwise might have been expected, which he believes are the most compelling industrial synergies available in the sector, plus the merger synergies of $800m. The pushback from investors has been to question whether these financial benefits are unique to this combination. Namely, why couldn’t standalone Teck and its partners seek to negotiate an asset-level merger of QB with the Collahuasi owners if the financial benefits are so compelling, or to what extent is a corporate-level merger that creates a majority owner across both assets necessary to unlock these discussions? Likewise, with the identified $800m of merger synergies coming from Board & Corporate, Procurement and Marketing savings, investors have questioned whether these would be equally sizable for other industry players.

Much of the debate has focused on the potential for a competing bid for Teck, which we discuss below. There has of course also been some debate with regards to potential offers for Anglo. Whilst it is widely seen as having a higher quality asset portfolio and therefore a potential better fit for the larger players, most notably BHP or Rio, valuation is seen as a significant deterrent. Not only is the higher quality asset base reflected in its higher valuation compared to that of Teck, but it also trades at a premium multiple to its larger peers. Furthermore, in the event of an approach, the Anglo board would most likely weigh this against not just the current group valuation but also against the potential valuation and prospects of an enlarged Anglo-Teck copper-focused player post synergy benefits, post disposals and all with a premium valuation, plus a control premium - so a potentially very high hurdle to get over - and one which most see as likely too high.

Investment Canada Act – Defining ‘Exceptional’

The need for Investment Canada Act approval is clearly a major talking point. With the necessary hurdle for a merger to meet the ‘net benefit’ test having recently been raised to the ‘most exceptional of circumstances’ level for critical minerals companies, there is clearly debate as to whether this proposed merger meets that criteria and, if it does, whether it uniquely does or whether other potential suitors could also pass the test? It has been commented on that it seems very early in the process for the Teck CEO to be writing articles in the press about the unique benefits of the deal for Canada and asking whether this is a sign of concern or defensiveness? Likewise, the commentary that no-one else other than Anglo would be likely to meet the apparent ‘personal’ demand of Canadian PM Carney to HQ the enlarged business in Canada or the personal demand of Keevil to keep the Teck name has also provoked discussion as to who this serves? Is it an attempt to warn off potential interlopers, and is an HQ really what it takes to be ‘exceptional’, or might others be approved through other attributes that are ‘exceptional’ in other ways, i.e. there is no single set of demands that need to be met? In this vein, we have taken a look at the pro-Canadian attributes of other companies in the sector in turn below, including current and historic investments in assets in the country, employees, ESG credentials and Canadian senior management - all of which point to Anglo not seeming to be uniquely placed, especially since weight is likely to be given to historic behaviour in country rather than just future promises.

Barrick: Despite Barrick Mining Corp (B US / Market Cap $58bn) being headquartered in Toronto, an acquisition of control of Teck would trigger ICA review under article 26 of the ICA due to the company not being majority-owned by Canadians. Barrick’s current Canadian operating footprint is modest (only Hemlo gold mine in Canada) compared with Rio Tinto PLC (RIO LN / Market Cap £83bn) or Vale S.A (VALE3 BZ / Market Cap $49bn); therefore, capex, employment, etc., aren't among the selling points. However, its governance, tax base and senior decision-making already reside in Canada, aligning with policy preferences to retain control of strategic assets domestically. This can be very relevant after the July 2024 statement that future large critical minerals deals will be “net benefit only in the most exceptional of circumstances.”

BHP: Politically, BHP arrives with a live, nation-scale project in Canada: the Jansen potash mine in Saskatchewan (Stage 1 sanctioned in 2021; Stage 2 in 2023) with thousands of construction workers and ~600 ongoing operational jobs planned, and a stated goal of 20% Indigenous employment at start-up. That footprint and its growing capex base are positives in any ICA “net benefit” consideration for Teck, especially for jobs, capital, supply chains and local procurement in Canada. That said, the Jansen project has seen cost/timing pressure and a revised first-production window to mid-2027, which Ottawa and Regina will know about when weighing the credibility of further undertakings. BHP’s 2010 hostile bid for PotashCorp failed ICA’s net-benefit test amid strong provincial resistance; that history still colours perceptions and means BHP would need unusually robust, enforceable undertakings around Canadian jobs, capex, HQ-style functions in Vancouver, Indigenous participation and R&D to overcome the scepticism. Copper/potash are now treated as strategic, so Ottawa’s 2024 “exceptional circumstances” stance on big critical-minerals transactions implies a high bar for any full Teck change-of-control. The 2010 PotashCorp rejection will shadow any BHP bid; however, its Canadian reputation has been steadily rehabilitated through the multi-billion-dollar Jansen build, First Nations agreements and a visible Saskatchewan workforce - Canadian national Mike Henry as CEO should also help in any endeavours.

Glencore: Glencore plc (GLEN LN / Market Cap £40bn) just passed a seven-month ICA “net-benefit” review to buy Teck’s Elk Valley Resources (EVR) coal business, but only with unusually strict undertakings: keep EVR’s Canadian HQ for 10 years, a majority-Canadian board, and employment commitments for at least five years. At the same time, the minister issued a policy signal that large critical minerals deals would be net-benefit only in exceptional cases. Glencore’s broader Canadian footprint is substantial (≈12,000 workers and contractors; Sudbury INO, Raglan, Horne, Kidd) and it has longstanding Inuit and First Nations agreements (e.g., the 1995 Raglan Agreement). Yet Horne Smelter’s arsenic emissions drew sustained Quebec intervention and national scrutiny, tempering its soft-power profile. A full Teck change-of-control bid would meet a very high ICA bar on critical-minerals control and face environmental/Indigenous-related political noise in BC, given cumulative water issues in the Elk Valley watershed and Horne’s legacy. Passing is possible but would demand heavy, enforceable undertakings on BC jobs, HQ functions, Indigenous partnerships and environmental remediation, at least as stringent as EVR.

Rio Tinto: Among foreign bidders, Rio has the deepest Canadian “grip.” It employs ~14,100 people in Canada across aluminium, iron ore, titanium, diamonds, and R&D, with C$6.3 billion of Canadian spend and C$500m of 2024 tax/royalty payments. It is also investing C$1.4bn to expand low-carbon aluminium smelting in Saguenay-Lac-Saint-Jean, adding 1,000 construction jobs and ~100 permanent roles. Indigenous commitments are established through multiple Impact and Socio-Economic Agreements, explicit Indigenous-hiring targets at Diavik, and long-running arrangements with Innu and NunatuKavut in Labrador. Rio is not an SOE, and its Canadian record includes positive signals on decarbonisation grants and awards. On ICA net-benefit, Rio starts from a strong baseline of Canadian employment, capex and Indigenous relationships relative to Anglo and other peers - this makes RIO one of the bidders with the highest chance of success. Additionally, Rio's Chairman, Dominic Barton, is Canadian and has been Teck's Chairman for the period 2018-2019 after his role as Canadian Ambassador to China. One question that has arisen specific to Rio is how the Canadians may view China Copper Mineral Resources Co Ltd (CHINALCO CH / Private) as a 15% shareholder, although we would note that Teck already has a Chinese investor as its largest shareholder, namely China Investment Corporation (CHIVCZ CH / Private).

Vale: Vale is deeply embedded in Canada through long-standing mining and processing operations across multiple provinces via its Vale Canada subsidiary. Its Sudbury complex, with five mines, a smelter, refinery and nearly 4,000 employees, is one of the world’s largest integrated mining hubs. Nickel and copper concentrate from Voisey’s Bay is refined at Long Harbour, while the century-old Port Colborne refinery continues to process cobalt and precious metals. In Ontario, Vale also maintains its global Base Metals Headquarters and a Technology Development Centre in Mississauga, alongside corporate offices in Toronto that oversee legal, finance and strategic functions. Manitoba’s Thompson operations, dating back to 1956, reinforce Vale’s multi-provincial footprint and deep Canadian tax and employment base. This scale strengthens ICA net-benefit arguments: production, processing, corporate decision-making and R&D are all embedded domestically. Recent impairments totalling c. $1.9bn linked to Canadian nickel operations and the Voisey’s Bay expansion underscore both scale and headwinds, but also demonstrate continued investment. Indigenous 'impacts and benefits agreements’ (IBAs) at Voisey’s Bay and established relationships in Labrador, northern Ontario and Manitoba are positives, though recent strikes and operating challenges will be noted. Any potential approach by Vale to Teck would still face Ottawa’s high bar, requiring undertakings on BC jobs, Vancouver-based functions, Indigenous benefit-sharing and accelerated copper growth.

For completeness' sake, Agnico Eagle Mines Limited (AEM US / Market Cap $80bn) CEO Ammar Al-Joundi has publicly confirmed that the company is not considering a takeover bid for Teck. He emphasised that Agnico’s focus remains squarely on organic growth opportunities rather than large-scale M&A. Additionally, Freeport-McMoRan Inc. (FCX US / Market Cap $51bn) has never been a top candidate interloper throughout the several conversations we had with our sources, and following Wednesday's incident at Grasberg Block Cave Mine in Indonesia, this is unlikely to change in the foreseeable future.

ICA Framework

The ICA applies to investments by non-Canadians and requires that a reviewable takeover be “likely to be of net benefit to Canada.” Ottawa runs a separate national-security screen ahead of the net benefit review. Recent changes added pre-closing notices for prescribed sensitive sectors, powers to impose interim conditions and extend timelines, and sharper guidance that treats critical minerals supply chains as high risk. On 4 July 2024, the Industry Minister stated that takeovers of important Canadian miners engaged in significant critical-minerals operations would only be found to be of net benefit in “the most exceptional of circumstances.” The Competition Bureau will review the merger alongside Innovation, Science and Economic Development Canada (ISED); with Teck’s coal business sold and copper refining concentrated outside the parties, the Canadian overlap analysis is narrower than past Teck scenarios due to the coal disposal, though the Bureau will still test concentrate flows, downstream access and potential vertical or conglomerate effects under the tighter 2024-25 merger framework.

Canada will judge Anglo-Teck on whether it delivers a clear, measurable net benefit under section 20 of the ICA. What has been publicly reported as having been put on the table to satisfy regulators in Canada checks a lot of boxes, based on conversations we have had. An interloper wouldn't necessarily be required to meet the same commitments, but rather check the same boxes in ways that achieve similar outcomes. A Canadian global HQ in Vancouver helps, but is not necessarily essential, depending on what else is in the ‘package’ of benefits for Canada. Ottawa will expect incremental jobs and payroll in Canada, multi-year capex that maintains or expands on-shore processing, Canadian-supplier spend, R&D and skills programmes, and meaningful Canadian participation in governance and decision-making. Authorities expect these to be converted into enforceable undertakings with location-specific targets, reporting, audit rights and consequences for non-performance. Form must match function: the Canadian HQ must hold real authority - budget ownership, named officers resident in Canada, reserved matters decided in Canada - and a board composition that embeds Canadian oversight. A TSX listing and active Canadian shareholder engagement support, but do not replace, decision-making substance in Canada.

Critical minerals set the bar. Ottawa will look for commitments that strengthen Canadian control and resilience in copper and associated value chains: tangible investment in British Columbia (B.C.) operations (Highland Valley and Trail or successors), capacity for processing critical inputs in Canada, support for domestic exploration, and transparency on offtake and marketing so supply decisions align with Canadian policy. B.C. is also of crucial importance. The province and affected Indigenous Nations will likely expect benefits: headcount and apprenticeship targets in B.C., capex for mines and processing, local-procurement thresholds, and dedicated funding for community infrastructure and environmental outcomes. Federal decision-makers take into consideration provincial and Indigenous submissions; therefore, robust local agreements reduce bumps on the road and shorten negotiations.

Precedents

Two recent, public-company transactions reviewed under the updated 2024–25 Canadian framework show how Ottawa now runs these files: Stelco Holdings Inc. (STLC CN / Private) / Cleveland-Cliffs Inc. (CLF US / Market Cap $6bn) and Arcadium Lithium PLC (ALTM US / Private) / Rio Tinto both cleared quickly, one with detailed ICA undertakings and one with remedies that weren't made public. These outcomes confirm the ICA’s purpose: not to block for the sake of blocking, but to secure net benefit for Canadians through enforceable commitments where needed. Historically, outright ICA prohibitions are rare as the Act is used to extract jobs, capex, governance and transparency undertakings that align deals with Canadian interests.

Stelco/Cleveland-Cliffs (2024): Cleveland-Cliffs is a vertically integrated US iron-ore and flat-rolled steel producer supplying automakers and industry, while Stelco was a Canadian flat-rolled steelmaker based in Ontario - the deal closed in 109 days. Canada cleared this sensitive steel deal in two steps: first, the Competition Bureau issued a no-action letter on 9 October 2024, signalling it would not challenge the merger under the Competition Act; second, the Minister of Innovation approved the investment under the Investment Canada Act with a package of binding five-year undertakings. Those undertakings required Cliffs to keep Stelco’s head office in Hamilton, retain at least the same number of unionised workers and the vast majority of non-unionised staff, honour all CBAs and pension commitments, make “significant” capital and R&D spending, and ensure Scope 1/2 emissions intensity at least 25% below the global average for integrated mills; the companies then announced closing for 1 November 2024.

Arcadium Lithium / Rio Tinto (2024): Arcadium Lithium was a global producer of battery-grade lithium chemicals (carbonate, hydroxide and specialties), while Rio Tinto is a diversified mining group focused on iron ore, aluminium and copper with a growing battery-materials business - the deal closed in 148 days. Due to the critical sector involved, Canada ran both merger-control and foreign-investment screens. Competition Canada clearance was secured in December 2024 as part of a global set of antitrust approvals, and on 13 February 2025, Arcadium disclosed receipt of all required foreign-investment approvals, explicitly including Investment Canada Act clearance; the transaction closed on 6 March 2025. No public Canadian undertakings were disclosed, but the timing shows that, even post-2024 policy hardening, Ottawa can clear large critical-minerals deals where competition overlaps are limited and the buyer has a deep Canadian footprint and credibility on project investment. This provides a relevant counterpoint: stringent ICA outcomes (Stelco/Cliffs) versus a faster, conditions-light path (Arcadium/Rio) in critical minerals, framing the range of outcomes for a Teck/Anglo review.

Politicians Are Quick To Voice Their Views

Upon the Anglo/Teck deal announcement, Canadian politicians and indigenous leaders didn't wait long to voice their concerns and requests. The BC Chamber of Commerce immediately welcomed the deal as a vote of confidence in British Columbia. The United Steelworkers, representing 2,500 Teck employees, struck a more cautious tone, saying they were “cautiously optimistic” about commitments on Canadian jobs and a Vancouver headquarters. BC Premier David Eby hailed the deal as “the largest company in the history of British Columbia” and promised to lobby Ottawa. Federal regulators quickly confirmed that the Competition Bureau would review the transaction.

Teck CEO Jonathan Price has called the move “a perpetual commitment,” adding that relocating senior executives would be “a great thing for the country.” At the same time, Anglo CEO Duncan Wanblad sought to reassure critics, insisting “Canada is a great mining jurisdiction … I have no doubt that we’ll end up having legally binding commitments here with Canada,” while ruling out any shift from London as the primary listing.

But Industry Minister Mélanie Joly has raised the bar, warning that current pledges are “not enough.” She said Ottawa expected not just jobs today but “a strong headquarters, not only now, but also for the next decade,” and will meet both CEOs this week. Indigenous leaders have also demanded a greater role. Chief Clarence Louie of the Osoyoos Indian Band cautioned that “deals of this scale … cannot be completed without the title holders on whose lands these mines and smelters are situated being included,” calling for full consultation before approval.

Conclusion

The strategic logic of the combination to create a copper-focused mining company is well understood. However, there is an underlying question of whether this is actually more of a defensive move by both parties against the pressures that they find themselves confronting. Overall, the structure of the combination is seen as a better outcome for Anglo than Teck, but it has merits for both. The key questions raised by Teck shareholders are around the rationale for the timing and for accepting a nil-premium proposal at a time when the Teck valuation is at its recent lows, whilst Anglo’s is at recent highs. This disparity in multiples therefore gives rise to Teck shareholders owning a smaller portion of the equity of the enlarged group than might otherwise have been expected based on historic contribution ratios. We have been heavily engaged with stakeholders around the situation since deal announcement and will continue to be so – we thought this note to be a timely update on the key areas of feedback and points of debate in the past two weeks.