Merck KGaA (MRK GR / Market Cap EUR53bn), the German healthcare and technology group, has this morning announced its agreement to acquire SpringWorks Therapeutics (SWTX US / Market Cap $3.5bn), a U.S.-based biotech firm specializing in cancer and rare disease treatments which was which was spun out of Pfizer in 2017. The deal, valued at $47 per share or $3.9bn, is coming after Merck confirmed on 10th February being in advanced discussions with SpringWorks Therapeutics on the back of press leaks.

There is little detail in the PR this morning: The transaction has been unanimously approved, by all those in attendance, by both the Merck and SpringWorks Boards of Directors and is expected to close in the second half of 2025, subject to satisfaction of customary closing conditions, including approval of SpringWorks’ shareholders and receipt of required regulatory approvals. Talking to IR this morning, they were not [yet] aware of a minimum acceptance condition but suggested it might be a question for the call later.

J.P. Morgan is acting as exclusive financial advisor and Sullivan & Cromwell LLP is acting as legal counsel to Merck. Centerview Partners LLC and Goldman Sachs & Co. LLC are acting as joint financial advisors to SpringWorks, and Goodwin Procter LLP is acting as SpringWorks’ legal counsel.

There is a call / webcast this afternoon at 1pm BST today.

Strategic rationale

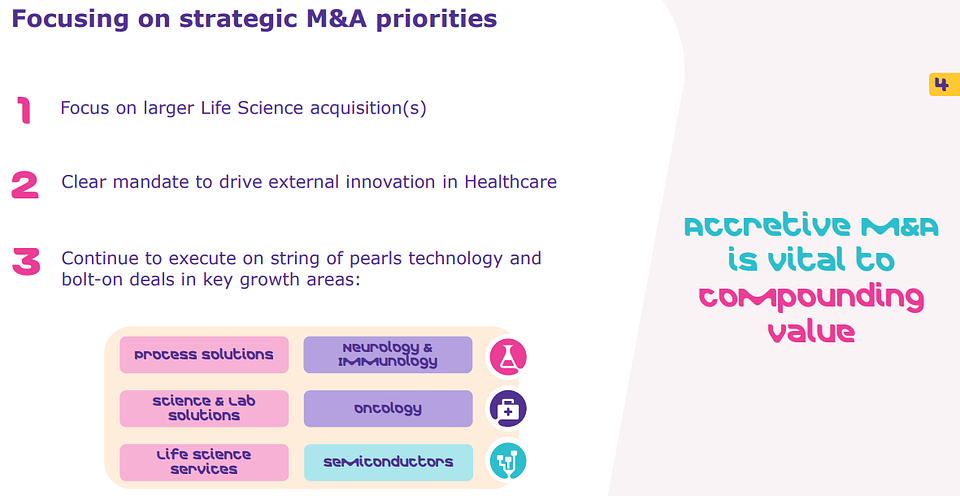

This acquisition is part of Merck's strategy to bolster its product pipeline, especially after some recent R&D setbacks, including for much-touted head and neck cancer candidate xevinapant, which was abandoned after it failed a phase 3 trial last year, and multiple sclerosis therapy evobrutinib, which was dropped at the end of 2023. The transaction fits Merck’s strategic positioning as a leading science and technology company, laid out as recently as at their 17th October2024 capital markets day that for larger future transactions, Merck is focusing on the Life Science business sector. CEO Belén Garijo said: “M&A remains a key priority for Merck. And we remain disciplined and patient in our approach in order to maximize the strategic impact of any acquisitions. Our guiding principle is and always has been: The right target, at the right time, for the right price.” In their PR this morning, Merck reiterates this very point and also highlights the fact that the transaction also fits with the strategic objectiveof strengthening Merck’s Healthcare presence in the United States, the world’s largest pharmaceutical market.

Merck KGaA’s interest in acquiring SpringWorks Therapeutics aligns with its broader strategic direction, particularly strengthening its healthcare division to offset revenue losses from patent expirations. Merck’s life sciences division remains the company’s long-term focus, but recent commentary from management suggested a parallel priority of shoring up its pharmaceutical pipeline. The company faces revenue headwinds from the impending loss of exclusivity (LOE) on key drugs, notably Mavenclad, its multiple sclerosis (MS) treatment, and Bavencio, which is struggling to compete in the oncology space. The estimated loss of revenue from these three drugs alone could amount to shy of 5% of Merck’s global revenues.

From a strategic standpoint, Merck’s existing oncology business already includes Bavencio for Merkel cell carcinoma and Tepmetko for MET exon 14 mutant lung cancer, making the addition of SpringWorks' assets a complementary fit. While Merck focuses on treatments for common tumours, SpringWorks focuses on developing targeted therapies for rare cancers. With no apparent signs of overlap, integrating SpringWorks' products into Merck’s portfolio creates marketing and sales synergies. Furthermore, given that Merck has €15 billion of available capital for acquisitions, this deal just about fits within its communicated $2–4 billion range for smaller-scale healthcare M&A.

SpringWorks is known for its FDA-approved treatment for desmoid tumors (“DT”, Ogsiveo), a rare soft tissue tumor with limited treatment options, and its MEK inhibitor mirdametinib (Gomekli). Ogsiveo (nirogacestat; gamma secretase inhibitor) is the first and only FDA approved therapy for DT and is being tested in ovarian granulosa cell tumors (“OvGCT”), with initial Ph2 data expected in the first half of 2025. Gomekli received a clean label in both adults and children from the FDA in its PDUFA on 11th Feb, earlier than expected (the deadline was 28th February). It is slated to become SpringWorks’ second commercial medicine and would be the first therapy cleared by the FDA for both adults and children with neurofibromatosis type 1 (“NF1”) who have symptomatic plexiform neurofibromas (“PN”). Mirdametinib will now have to go toe-to-toe with AstraZeneca’s Koselugo in the U.S. market. Just last night, Springworks issued a press release, saying that it expects the EMA CHMP opinion for Nirogacestat for the Treatment of Adults with Desmoid Tumors in the European Union in Q2 2025.

SpringWorks holds strategic value given Ogsiveo's launch trajectory and the company's potential to become a multi-product story. Both of the company's lead drugs could become $1 billion-type products at peak. This acquisition significantly bolsters Merck KGaA's portfolio in oncology and rare diseases.

This strategy is common in big pharma M&A, where larger firms acquire specialised biotech companies to access low-risk, late-stage assets with strong commercial potential. With oncology remaining a high-priority therapeutic area, SpringWorks' portfolio can help Merck sustain long-term revenue growth.

There is little detail in the PR this morning: The transaction has been unanimously approved, by all those in attendance, by both the Merck and SpringWorks Boards of Directors and is expected to close in the second half of 2025, subject to satisfaction of customary closing conditions, including approval of SpringWorks’ shareholders and receipt of required regulatory approvals. Talking to IR this morning, they were not [yet] aware of a minimum acceptance condition but suggested it might be a question for the call later.

J.P. Morgan is acting as exclusive financial advisor and Sullivan & Cromwell LLP is acting as legal counsel to Merck. Centerview Partners LLC and Goldman Sachs & Co. LLC are acting as joint financial advisors to SpringWorks, and Goodwin Procter LLP is acting as SpringWorks’ legal counsel.

There is a call / webcast this afternoon at 1pm BST today.

Strategic rationale

This acquisition is part of Merck's strategy to bolster its product pipeline, especially after some recent R&D setbacks, including for much-touted head and neck cancer candidate xevinapant, which was abandoned after it failed a phase 3 trial last year, and multiple sclerosis therapy evobrutinib, which was dropped at the end of 2023. The transaction fits Merck’s strategic positioning as a leading science and technology company, laid out as recently as at their 17th October2024 capital markets day that for larger future transactions, Merck is focusing on the Life Science business sector. CEO Belén Garijo said: “M&A remains a key priority for Merck. And we remain disciplined and patient in our approach in order to maximize the strategic impact of any acquisitions. Our guiding principle is and always has been: The right target, at the right time, for the right price.” In their PR this morning, Merck reiterates this very point and also highlights the fact that the transaction also fits with the strategic objectiveof strengthening Merck’s Healthcare presence in the United States, the world’s largest pharmaceutical market.

Merck KGaA’s interest in acquiring SpringWorks Therapeutics aligns with its broader strategic direction, particularly strengthening its healthcare division to offset revenue losses from patent expirations. Merck’s life sciences division remains the company’s long-term focus, but recent commentary from management suggested a parallel priority of shoring up its pharmaceutical pipeline. The company faces revenue headwinds from the impending loss of exclusivity (LOE) on key drugs, notably Mavenclad, its multiple sclerosis (MS) treatment, and Bavencio, which is struggling to compete in the oncology space. The estimated loss of revenue from these three drugs alone could amount to shy of 5% of Merck’s global revenues.

From a strategic standpoint, Merck’s existing oncology business already includes Bavencio for Merkel cell carcinoma and Tepmetko for MET exon 14 mutant lung cancer, making the addition of SpringWorks' assets a complementary fit. While Merck focuses on treatments for common tumours, SpringWorks focuses on developing targeted therapies for rare cancers. With no apparent signs of overlap, integrating SpringWorks' products into Merck’s portfolio creates marketing and sales synergies. Furthermore, given that Merck has €15 billion of available capital for acquisitions, this deal just about fits within its communicated $2–4 billion range for smaller-scale healthcare M&A.

SpringWorks is known for its FDA-approved treatment for desmoid tumors (“DT”, Ogsiveo), a rare soft tissue tumor with limited treatment options, and its MEK inhibitor mirdametinib (Gomekli). Ogsiveo (nirogacestat; gamma secretase inhibitor) is the first and only FDA approved therapy for DT and is being tested in ovarian granulosa cell tumors (“OvGCT”), with initial Ph2 data expected in the first half of 2025. Gomekli received a clean label in both adults and children from the FDA in its PDUFA on 11th Feb, earlier than expected (the deadline was 28th February). It is slated to become SpringWorks’ second commercial medicine and would be the first therapy cleared by the FDA for both adults and children with neurofibromatosis type 1 (“NF1”) who have symptomatic plexiform neurofibromas (“PN”). Mirdametinib will now have to go toe-to-toe with AstraZeneca’s Koselugo in the U.S. market. Just last night, Springworks issued a press release, saying that it expects the EMA CHMP opinion for Nirogacestat for the Treatment of Adults with Desmoid Tumors in the European Union in Q2 2025.

SpringWorks holds strategic value given Ogsiveo's launch trajectory and the company's potential to become a multi-product story. Both of the company's lead drugs could become $1 billion-type products at peak. This acquisition significantly bolsters Merck KGaA's portfolio in oncology and rare diseases.

This strategy is common in big pharma M&A, where larger firms acquire specialised biotech companies to access low-risk, late-stage assets with strong commercial potential. With oncology remaining a high-priority therapeutic area, SpringWorks' portfolio can help Merck sustain long-term revenue growth.

Fig 1: Merck KGaA strategic M&A priorities CMD October 2024 (Source: Company website)

Therapeutical overlaps

While both companies operate in oncology, they focus on different areas within the space. Merck’s oncology portfolio includes immunotherapies and targeted treatments such as Bavencio (avelumab), which is approved for Merkel cell carcinoma, urothelial carcinoma, and renal cell carcinoma, as well as Tepmetko (tepotinib) for MET-driven lung cancer.SpringWorks, on the other hand, specialises in rare oncology and rare disease indications. Its flagship drug, Ogsiveo (nirogacestat), targets desmoid tumours, a niche but high-value market. Additionally, mirdametinib addresses neurofibromatosis type 1-associated plexiform neurofibromas (NF1-PN) in adult and paediatric patients, setting it apart from Merck’s existing offerings.

Rather than an overlap, this deal represents a diversification play for Merck, expanding its rare oncology and rare disease footprint. Given that both Ogsiveo and mirdametinib have intellectual property protection until 2039 and 2041, respectively, this provides a longer revenue tail, which is particularly attractive given the near-term patent cliff facing Merck.

SpringWorks focuses on treatments for patients with rare tumours, haematological cancers and biomarker-defined metastatic solid tumours. The company currently has two commercial products:

While both companies operate in oncology, they focus on different areas within the space. Merck’s oncology portfolio includes immunotherapies and targeted treatments such as Bavencio (avelumab), which is approved for Merkel cell carcinoma, urothelial carcinoma, and renal cell carcinoma, as well as Tepmetko (tepotinib) for MET-driven lung cancer.SpringWorks, on the other hand, specialises in rare oncology and rare disease indications. Its flagship drug, Ogsiveo (nirogacestat), targets desmoid tumours, a niche but high-value market. Additionally, mirdametinib addresses neurofibromatosis type 1-associated plexiform neurofibromas (NF1-PN) in adult and paediatric patients, setting it apart from Merck’s existing offerings.

Rather than an overlap, this deal represents a diversification play for Merck, expanding its rare oncology and rare disease footprint. Given that both Ogsiveo and mirdametinib have intellectual property protection until 2039 and 2041, respectively, this provides a longer revenue tail, which is particularly attractive given the near-term patent cliff facing Merck.

SpringWorks focuses on treatments for patients with rare tumours, haematological cancers and biomarker-defined metastatic solid tumours. The company currently has two commercial products:

- OGSIVEO® (nirogacestat): Approved on 27th November 2023, it is an oral, small molecule gamma secretase inhibitor (GSI) approved in the U.S. for the treatment of adult patients with progressing desmoid tumors who require systemic treatment. It is also being evaluated for other indications, including ovarian granulosa cell tumors and as part of B-cell maturation agent (BCMA) combination therapy regimens for multiple myeloma.

- GOMEKLI™ (mirdametinib): An oral, small molecule MEK inhibitor approved in the U.S. for the treatment of adult and pediatric patients with neurofibromatosis type 1 (NF1) who have symptomatic plexiform neurofibromas (PN) not amenable to complete resection. It got FDA approval on 11th February 2025.

Merck, one of the most prominent players in the healthcare industry, has a vast presence in every segment, including oncology. However, only 9% (EUR1.8bn) of its $21bn revenue in 2023 was generated from the oncology division. When diving deeper into Merck’s products, it becomes evident that the addressed market differs significantly from SpringWorks’ as - other than in the case of Merkel cell carcinoma (“MCC”), a rare and aggressive skin cancer - Merck’s oncology department focuses on more common types of cancers:

- Bladder Cancer: Urothelial cancer, the most common form of bladder cancer.

- Blood Cancer: Including leukemia, lymphoma, and myeloma.

- Breast Cancer: With a focus on aggressive subtypes like triple-negative breast cancer (TNBC).

- Gastrointestinal (GI) Cancers: Such as esophageal, gastric (stomach), colorectal, pancreatic, and liver cancers.

- Gynecological Cancers: Including ovarian, cervical, uterine (endometrial), vaginal, and vulvar cancers.

- Head and Neck Cancer: Tumors developing in or around the throat, larynx, nose, sinuses, and mouth.

- Lung Cancer: The leading cause of cancer deaths globally.

- Melanoma: A serious form of skin cancer.

- Prostate Cancer: The second most common cancer in people assigned male at birth.

- Renal Cell Carcinoma: The most common type of kidney cancer

Merck’s current commercial offerings in the oncology division include the following three treatments:

- Erbitux is Merck’s best-selling drug, as it generated more than EUR1bn in sales in 2023. The drug is a standard treatment for patients affected by different types of cancer, such as EGFR-expressing (epidermal growth factor receptor), RAS wild-type metastatic colorectal cancer, and RAS wild-type metastatic colorectal cancer.

- Bavencio is an anti-PD-L1 antibody and is approved as a first-line maintenance treatment for advanced urothelial carcinoma in 71 countries. It’s also approved for the treatment of advanced renal cell carcinoma in combination with axitinib. Lastly, it is a standard of care (“SOC”) as a monotherapy in metastatic Merkel cell carcinoma, a rare form of skin cancer.

- Tepmetko is an oral MET inhibitor designed to inhibit the oncogenic MET receptor signalling caused by MET (gene) alterations, currently available in 43 markets globally.

Due to the different types of tumours the treatments address, it is hard to foresee any competition issues under the framework outlined by the EC in its 2021 approval decision of the Alexion Pharmaceuticals / Astra Zeneca deal. The commission's first distinction is in terms of the addressable market; AstraZeneca’s treatments target common diseases, while Alexion solely focuses on rare and ultra-rare diseases. The SpringWorks / Merck deal displays a similar pattern.

The pipelines

It’s, however, worth analysing the two pipelines to address any potential drug overlap at the testing stage:

The pipelines

It’s, however, worth analysing the two pipelines to address any potential drug overlap at the testing stage:

Fig 2: Merck KGaA oncology pipeline (Source: Company website)

Fig 3: SpringWorks Therapeutics pipeline (Source: Company website)

The two pipelines differ considerably, and there does not seem to be an overlap on any of the drugs currently in testing phase. We are, of course, acutely aware of the recent Maze Therapeutics / Sanofi precedent which Sanofi terminated on 11th December 2023 after the FTC sued to block. The FTC moved to dismiss its case challenging the transaction after Sanofi decided to terminate the agreement. From the press release: “On December 11, 2023, the FTC sued to block Sanofi’s acquisition of an exclusive license to Maze’s Phase 2-ready developmental drug—a glycogen synthase 1 inhibitor called MZE001— alleging the deal would eliminate a nascent competitor poised to challenge Sanofi’s monopoly in the Pompe disease therapy market. After the FTC issued an administrative complaint and authorized a lawsuit in federal court, Sanofi announced it would terminate its agreement with Maze. The FTC then moved to dismiss its federal court and administrative challenge on December 13, 2023.”

The key difference, however, we see is that both companies were treating Pompe disease and that Sanofi was acquiring an exclusive licence for Maze's Phase 2-ready developmental drug, a glycogen synthase 1 inhibitor called MZE001. The FTC claimed the deal would eliminate a potential competitor that could challenge Sanofi's monopoly in the Pompe disease therapy market.

The FTC also scrutinized Roche's acquisition of Spark Therapeutics in 2019 due to concerns about potential overlaps in their haemophilia gene therapy pipelines. The deal was eventually cleared after a thorough 10-months investigation.

Merck KGaA, shareholder influence, and M&A precedents

For those not familiar with Merck’s peculiar ownership structure, whilst listed as a public share company, Merck KGaA's corporate governance is shaped by its unique legal structure as a Kommanditgesellschaft auf Aktien (“KGaA”), or partnership limited by shares. Unlike your standard Aktiengesellschaft (“AG”), management of a KGaA is organised around a blend of LPs (aka shareholders) and unlimited LPs (aka GPs), which affects how decisions are made and how liability is handled.

The key difference, however, we see is that both companies were treating Pompe disease and that Sanofi was acquiring an exclusive licence for Maze's Phase 2-ready developmental drug, a glycogen synthase 1 inhibitor called MZE001. The FTC claimed the deal would eliminate a potential competitor that could challenge Sanofi's monopoly in the Pompe disease therapy market.

The FTC also scrutinized Roche's acquisition of Spark Therapeutics in 2019 due to concerns about potential overlaps in their haemophilia gene therapy pipelines. The deal was eventually cleared after a thorough 10-months investigation.

Merck KGaA, shareholder influence, and M&A precedents

For those not familiar with Merck’s peculiar ownership structure, whilst listed as a public share company, Merck KGaA's corporate governance is shaped by its unique legal structure as a Kommanditgesellschaft auf Aktien (“KGaA”), or partnership limited by shares. Unlike your standard Aktiengesellschaft (“AG”), management of a KGaA is organised around a blend of LPs (aka shareholders) and unlimited LPs (aka GPs), which affects how decisions are made and how liability is handled.

![Fig 4: Merck KGaA corporate [governance] structure (Source: MKP Advisors, Company website)](https://prowly-prod.s3.eu-west-1.amazonaws.com/uploads/117497/assets/741334/large-9866476fe65070afe9cb03aa5a05f240.png)

Fig 4: Merck KGaA corporate [governance] structure (Source: MKP Advisors, Company website)

The following are the key features of its structure:

- Ownership structure: The Merck family controls approximately 70% of the company through E. Merck KG, giving them significant influence over corporate decisions. Public shareholders hold the remaining 30%.

- Executive Board: The Executive Board, comprising managing general partners, is responsible for the company's management. In contrast to a typical stock corporation, the Supervisory Board does not appoint the Executive Board; instead, the general partners hold this authority.

- Supervisory Board: The Supervisory Board oversees the company's management but has limited powers compared to those in a standard AG. For example, it cannot appoint or dismiss members of the Executive Board.

- German Corporate Governance Code: Merck KGaA complies with the principles of the German Corporate Governance Code, adapting them to fit its KGaA structure. This governance model ensures a balance between family control and public shareholder interests while maintaining transparency and accountability.

Merck KGaA has been a regular acquirer over the past two decades, and bar the competing bid for Schering AG which they lost to Bayer AG completed all six deals listed below. None of them required shareholder approval, not even the $16.4bn deal for Sigma-Aldrich: “The transaction has the full support of Merck’s Executive Board and E.Merck KG including its Board of Partners, and a Merck shareholder vote will not be required.” (PR available on request). And as they point out in their competing takeover bid for Versum against Entegris “Merck’s long track record of completing acquisitions”.

Fig 5: Merck KGaA M&A deals over the past 20 years (Source: MKP Advisors, Bloomberg)

As far as the Merck KGaA share price is concerned, the stock has been performing at the bottom of its peer group for the past 12 months and also since 7th February, the day prior to their ad-hoc release regarding advanced talks with SpringWorks Therapeutics. But the stock has not done materially worse than its peers or the EuroStoxx Healthcare index since the PR, suggesting shareholders have not voted with their feet and sold stock en masse. We also note that on their 6th March earnings call, the company got questions on the potential transaction, but not a barrage of flak against it. We do not know, of course, what is going on behind the scenes. However, given the lack of shareholder vote it seems to largely be irrelevant, ultimately.

Fig 6: Merck KGaA share price 12m and since 10th February vs peers (Source: MKP Advisors, Bloomberg)

Interlopers

Given the surprisingly low level of the offer at a premium of only ca 35% to the undisturbed price, and despite the board recommendation, there are question marks about that the likelihood of a competing offer; there are far and few precedents of interloping bids in recommended biotech deals. Given the relatively small size and interesting therapy area, other potential suitors could include major pharmaceutical companies with a strong interest in oncology and rare disease treatments. It is always hard to rule out the likes of Pfizer, Roche, or Novartis who all might be interested in acquiring SpringWorks due to their focus on expanding their oncology pipelines and innovative therapies. They all have a history of strategic acquisitions to bolster their portfolios and could see SpringWorks' promising pipeline as a valuable addition. And we would draw attention to the formidable patent cliff (also known as loss of exclusivity “LOE”) that is facing large cap pharma companies in Western Europe and the US, amounting to north of 30% for the likes of Pfizer or Novartis.

Conclusion

The transaction seems complimentary on the face of it and should not pose any antitrust issues. That being said, it is hard to entirely rule out an extended timeline for the deal to complete but ultimately this one should face a pretty straightforward path to completion. The wide timing guidance of H2 2025 attests to some uncertainty in this regard.

The main lingering question in the background will be the level the rather disappointingly low offer has been agreed at and if that leaves the door open to anyone else too show their hand now that we have price discovery. That said, our contacts suggest that the delay in the deal coming together was largely driven Merck's strategic decision to exert pressure on Springworks in an effort to secure a more favourable price - and it looks like their plan worked rather well, unwittingly helped by Liberation Day. And with the business having been on the market for so long, if there was another bidder, one would expect them to have shown up already, or that the press would have scooped them out.

Given the surprisingly low level of the offer at a premium of only ca 35% to the undisturbed price, and despite the board recommendation, there are question marks about that the likelihood of a competing offer; there are far and few precedents of interloping bids in recommended biotech deals. Given the relatively small size and interesting therapy area, other potential suitors could include major pharmaceutical companies with a strong interest in oncology and rare disease treatments. It is always hard to rule out the likes of Pfizer, Roche, or Novartis who all might be interested in acquiring SpringWorks due to their focus on expanding their oncology pipelines and innovative therapies. They all have a history of strategic acquisitions to bolster their portfolios and could see SpringWorks' promising pipeline as a valuable addition. And we would draw attention to the formidable patent cliff (also known as loss of exclusivity “LOE”) that is facing large cap pharma companies in Western Europe and the US, amounting to north of 30% for the likes of Pfizer or Novartis.

Conclusion

The transaction seems complimentary on the face of it and should not pose any antitrust issues. That being said, it is hard to entirely rule out an extended timeline for the deal to complete but ultimately this one should face a pretty straightforward path to completion. The wide timing guidance of H2 2025 attests to some uncertainty in this regard.

The main lingering question in the background will be the level the rather disappointingly low offer has been agreed at and if that leaves the door open to anyone else too show their hand now that we have price discovery. That said, our contacts suggest that the delay in the deal coming together was largely driven Merck's strategic decision to exert pressure on Springworks in an effort to secure a more favourable price - and it looks like their plan worked rather well, unwittingly helped by Liberation Day. And with the business having been on the market for so long, if there was another bidder, one would expect them to have shown up already, or that the press would have scooped them out.